Delve into the world of homeowners insurance companies, where protection and peace of mind go hand in hand. This guide is your key to understanding the ins and outs of choosing the right coverage for your home.

Overview of Homeowners Insurance Companies

Homeowners insurance companies play a crucial role in providing financial protection to homeowners in case of damage or loss to their property. These companies offer various policies that cover different types of risks, including theft, fire, natural disasters, and liability.

Examples of Well-Known Homeowners Insurance Companies

- Allstate: One of the largest homeowners insurance companies in the United States, offering a wide range of coverage options and discounts.

- State Farm: Known for its excellent customer service and customizable policies to meet the unique needs of homeowners.

- Liberty Mutual: A well-established insurance company that provides comprehensive coverage and personalized service to its customers.

Importance of Selecting a Reputable Homeowners Insurance Company

Choosing a reputable homeowners insurance company is essential to ensure that you receive reliable coverage and prompt assistance in the event of a claim. A reputable company will have a strong financial standing, positive customer reviews, and a history of efficiently handling claims.

This will give you peace of mind knowing that your home and belongings are protected by a trustworthy insurer.

Types of Coverage Offered

When it comes to homeowners insurance, there are different types of coverage options available to protect your home and belongings from various risks. Let's take a closer look at the types of coverage typically offered by homeowners insurance companies.

Standard Coverage

- Dwelling coverage: Protects the physical structure of your home from covered perils like fire, windstorms, and vandalism.

- Personal property coverage: Covers your belongings, such as furniture, clothing, and electronics, in case of theft or damage.

- Liability coverage: Provides financial protection if someone is injured on your property and decides to sue you.

- Additional living expenses: Helps cover the cost of temporary living arrangements if your home becomes uninhabitable due to a covered loss.

Additional Coverage Options

- Flood insurance: Protects your home and belongings from flood damage, which is usually not covered under standard homeowners insurance policies.

- Earthquake insurance: Covers damage to your home caused by earthquakes, as most standard policies do not include earthquake coverage.

- Scheduled personal property coverage: Allows you to insure high-value items like jewelry, art, and collectibles separately to ensure they are adequately protected.

Beneficial Coverage Examples

For example, if you live in an area prone to flooding, adding flood insurance to your policy can provide crucial protection against costly water damage that standard homeowners insurance does not cover.

Similarly, if you own valuable jewelry or art pieces, opting for scheduled personal property coverage can ensure that these items are fully protected in case of theft or damage.

Factors to Consider When Choosing a Homeowners Insurance Company

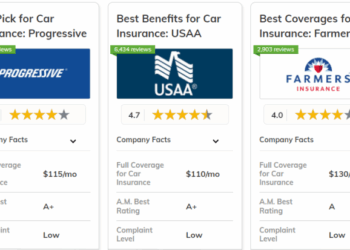

When selecting a homeowners insurance company, there are several key factors that homeowners should take into consideration to ensure they are making the right choice for their specific needs. Factors such as customer service, responsiveness, and financial strength ratings play a crucial role in the decision-making process.

Importance of Customer Service and Responsiveness

Customer service and responsiveness are essential aspects to consider when choosing a homeowners insurance company. A company that provides excellent customer service will be there to assist you when you need to file a claim or have any questions regarding your policy.

Additionally, responsiveness is crucial in times of emergencies, as you want an insurance provider that will act promptly and efficiently to address your needs.

- Look for companies with positive customer reviews and ratings for their customer service.

- Consider the ease of communication with the insurance company, such as through phone, email, or online chat.

- Check how quickly the company responds to inquiries and claims to gauge their level of responsiveness.

Financial Strength Ratings

Financial strength ratings are another important factor to consider when choosing a homeowners insurance company. These ratings indicate the financial stability and ability of the company to pay out claims in the event of a disaster or loss. It is crucial to select an insurance provider with a strong financial standing to ensure they can fulfill their obligations to policyholders.

Insurance companies with high financial strength ratings are more likely to have the resources to handle large-scale claims and provide timely payouts.

- Research the financial strength ratings of insurance companies from reputable rating agencies like A.M. Best, Standard & Poor's, or Moody's.

- Consider the company's history of paying out claims and their overall financial performance in the industry.

- Choose a company that has a solid financial foundation to provide you with peace of mind in the event of a claim.

Claims Process and Customer Experience

When it comes to homeowners insurance, the claims process and customer experience play a crucial role in determining the overall satisfaction with a company. A smooth and efficient claims process can make a difficult situation more manageable for homeowners, while a poor experience can lead to frustration and added stress.

Typical Claims Process

- Notify your insurance company: Contact your insurance provider as soon as possible to report the claim.

- Document the damage: Take photos and videos of the damage to provide as evidence.

- Meet with adjusters: An adjuster will assess the damage and estimate the cost of repairs.

- Receive payment: Once the claim is approved, you will receive payment for the damages, minus any deductible.

Tips for Ensuring a Smooth Claims Experience

- Understand your policy: Familiarize yourself with what is covered and any limitations in your policy.

- Act quickly: Report the claim promptly and provide all necessary documentation to expedite the process.

- Communicate effectively: Stay in touch with your insurance company and respond promptly to any requests for information.

- Keep records: Maintain a file with all communication and documentation related to the claim.

Real-Life Examples of Customer Experiences

Positive Experience: "After a storm damaged our roof, our insurance company handled the claim quickly and efficiently, and we were able to get the repairs done without any hassle."

Negative Experience: "When our basement flooded, our insurance company denied our claim, citing a technicality in the policy. We were left to cover the costly repairs on our own."

Pricing and Premiums

When it comes to homeowners insurance, pricing and premiums are crucial factors to consider. Understanding how insurance companies determine pricing, the factors that can influence costs, and strategies for potentially lowering premiums can help homeowners make informed decisions.

Factors Affecting Homeowners Insurance Costs

- Location: The geographic location of your home plays a significant role in determining insurance premiums. Areas prone to natural disasters or high crime rates may have higher premiums.

- Home Features: The age of your home, its construction materials, and the presence of safety features like smoke detectors and security systems can impact insurance costs.

- Coverage Limits: The amount of coverage you choose for your home and belongings will affect your premiums. Higher coverage limits typically result in higher premiums.

- Claims History: Your past claims history can influence the cost of your homeowners insurance. Multiple claims or a history of filing claims may lead to higher premiums.

- Credit Score: In some states, insurance companies may consider your credit score when determining premiums. A higher credit score could result in lower insurance costs.

Strategies to Lower Insurance Premiums

- Bundle Policies: Consider bundling your homeowners insurance with other insurance policies, like auto insurance, to potentially receive a discount.

- Improve Home Security: Installing security systems, smoke detectors, and other safety features in your home can lower the risk of claims and reduce premiums.

- Increase Deductibles: Opting for a higher deductible can lower your premiums, but remember that you'll need to pay more out of pocket in the event of a claim.

- Shop Around: Compare quotes from multiple insurance companies to find the best rate for your coverage needs. Don't hesitate to negotiate or ask for discounts.

- Maintain a Good Credit Score: Paying bills on time and maintaining a good credit score can help lower insurance premiums in states where credit is a factor.

Conclusive Thoughts

In conclusion, navigating the realm of homeowners insurance companies can be a daunting task, but armed with the right knowledge, you can make informed decisions to safeguard your most valuable asset - your home.

Key Questions Answered

How do I choose the best homeowners insurance company?

Consider factors like reputation, coverage options, customer service, and financial strength ratings to make an informed decision.

What are some common types of coverage offered by homeowners insurance companies?

Common types include dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

Can I lower my homeowners insurance premiums?

You can potentially lower premiums by increasing your deductible, bundling policies, improving home security, and maintaining a good credit score.

How do insurance companies determine pricing for homeowners insurance?

Pricing is determined based on factors such as the home's location, age, size, construction, and the homeowner's claims history.