Delving into the realm of best health insurance companies opens up a world of possibilities and crucial decisions. This guide aims to shed light on the key aspects that define these companies, offering readers a roadmap to navigate the complex landscape of health insurance providers.

As we unravel the intricacies of health insurance companies, we will uncover the factors that set them apart and explore the nuances of selecting the right provider for your needs.

Overview of Best Health Insurance Companies

Health insurance is a type of coverage that helps pay for medical expenses incurred by the insured individual. It provides financial protection by covering a portion of the costs associated with healthcare services, such as doctor visits, prescription medications, and hospital stays.

Key factors that make a health insurance company stand out include:

- Comprehensive Coverage: Offering a wide range of coverage options to meet the diverse needs of individuals and families.

- Network of Providers: Partnering with a broad network of healthcare providers, hospitals, and specialists to ensure access to quality care.

- Affordability: Providing competitive premiums, deductibles, and copayments to make healthcare accessible to a wide range of individuals.

- Customer Service: Delivering excellent customer service through responsive support, clear communication, and efficient claims processing.

- Add-On Benefits: Offering additional benefits such as wellness programs, telemedicine services, and preventive care to enhance overall health and well-being.

The importance of choosing the right health insurance provider cannot be overstated. Selecting a reputable and reliable company ensures that you have access to quality healthcare services when needed, without facing financial hardship. By considering factors such as coverage options, network of providers, costs, and customer service, you can make an informed decision that meets your healthcare needs and budget.

Top Health Insurance Companies in the Market

When it comes to health insurance, there are several top companies that stand out globally for their services, coverage, and customer satisfaction ratings. Let's take a closer look at some of the leading health insurance providers.

1. UnitedHealth Group

UnitedHealth Group is one of the largest health insurance companies in the world, offering a wide range of health insurance products and services. They provide comprehensive coverage for medical expenses, prescription drugs, and preventive care. UnitedHealth Group is known for its excellent customer service and innovative health programs.

2. Anthem

Anthem is another top health insurance company that offers a variety of health insurance plans to individuals and families. They focus on providing affordable and accessible healthcare coverage, with a strong network of healthcare providers. Anthem also emphasizes wellness programs and preventive care to help members stay healthy.

3. Aetna

Aetna is a well-established health insurance company that offers a range of health insurance plans for individuals, families, and employers. They are known for their broad network of healthcare providers and comprehensive coverage options. Aetna also provides innovative programs for managing chronic conditions and improving overall health outcomes.

4. Cigna

Cigna is a global health services company that offers a variety of health insurance plans, including medical, dental, and vision coverage. They focus on promoting health and well-being through preventive care and wellness programs. Cigna also provides personalized support for members to help them navigate the healthcare system and make informed decisions about their care.

Factors to Consider When Choosing a Health Insurance Company

When selecting a health insurance provider, it is crucial to consider various factors that can impact your coverage and overall healthcare experience. Factors such as coverage options, network size, premiums, and deductibles play a significant role in determining the suitability of a health insurance company for your needs.

Coverage Options

- Ensure the health insurance plan covers the medical services you need, such as doctor visits, hospital stays, prescription drugs, and preventive care.

- Check if the plan includes coverage for specialist consultations, mental health services, maternity care, and other specific healthcare needs you may have.

- Evaluate the extent of coverage for treatment of chronic conditions, emergency care, and out-of-network services to ensure comprehensive protection.

Network Size

- Consider the size of the provider network and the availability of healthcare facilities and professionals within the network.

- Ensure that your preferred doctors, hospitals, and specialists are included in the network to have access to quality care without incurring high out-of-pocket costs.

- Check if the network extends to different geographical areas to accommodate your healthcare needs when traveling or relocating.

Premiums and Deductibles

- Compare the premiums of different health insurance plans to find a balance between affordability and coverage benefits.

- Understand the deductible amount you will be required to pay before the insurance coverage kicks in and consider how it aligns with your budget and healthcare needs.

- Look for plans with lower out-of-pocket costs, copayments, and coinsurance percentages to minimize your financial burden when seeking medical treatment.

Customer Reviews and Satisfaction

Customer reviews and satisfaction play a crucial role in the health insurance industry. They provide valuable insights into the quality of service, coverage options, and overall customer experience offered by health insurance companies. By reading reviews and considering customer satisfaction ratings, individuals can make more informed decisions when choosing a health insurance provider.

Importance of Customer Reviews

- Customer reviews offer real-life experiences from policyholders, giving prospective customers an idea of what to expect.

- They help individuals assess the reliability and credibility of health insurance companies based on the feedback of existing customers.

- Reviews can highlight any potential issues or concerns with a particular insurance provider, allowing consumers to make educated choices.

Where to Find Reliable Customer Reviews

- Online review platforms such as Consumer Reports, Trustpilot, and Yelp feature reviews from actual customers of health insurance companies.

- Websites of insurance companies often have a section dedicated to customer testimonials and reviews.

- Seek recommendations from friends, family, or colleagues who have had positive experiences with their health insurance providers.

Closing Notes

In conclusion, the quest for the best health insurance company is a journey filled with choices and considerations. By understanding the intricacies of the industry and prioritizing key factors, individuals can make informed decisions that safeguard their health and financial well-being.

Expert Answers

What factors should I consider when choosing a health insurance company?

Consider coverage options, network size, premiums, and deductibles to ensure your health insurance meets your needs.

How important are customer reviews in the health insurance industry?

Customer feedback plays a crucial role in helping individuals make informed decisions about health insurance providers.

Where can I find reliable customer reviews for health insurance companies?

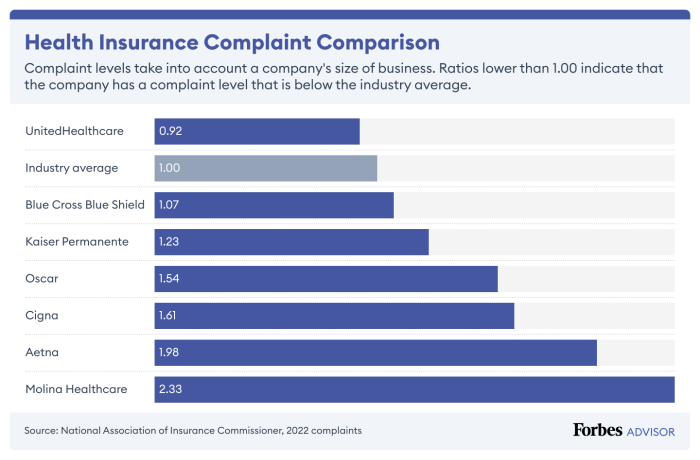

You can find trustworthy customer reviews on websites like Consumer Reports or the National Association of Insurance Commissioners.