In the world of auto insurance comparison, opportunities for significant savings and optimal coverage await. As we delve into the intricacies of comparing policies, prepare to be enlightened with valuable insights and practical tips that can revolutionize your insurance decisions.

Exploring the different facets of coverage options, premium considerations, and online tools, this guide will empower you to make informed choices and secure the best deals in the competitive landscape of auto insurance.

Overview of Auto Insurance Comparison

When it comes to auto insurance, comparing policies is crucial to ensure you are getting the best coverage at the most affordable price. By taking the time to compare different auto insurance plans, you can make an informed decision that meets your specific needs.

Importance of Comparing Auto Insurance Policies

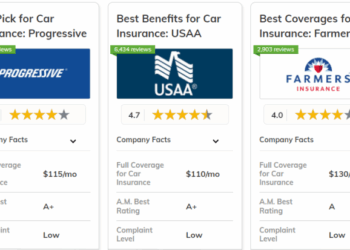

Comparing auto insurance policies allows you to evaluate the coverage options, deductibles, premiums, and additional benefits offered by different insurance providers. This helps you choose a policy that provides adequate coverage for your vehicle while staying within your budget.

How Auto Insurance Comparison Can Save Money

- By comparing quotes from multiple insurance companies, you can find the most competitive rates available in the market.

- Identifying discounts and special offers that may not be readily apparent can help you save money on your auto insurance premiums.

- Adjusting coverage levels and deductibles based on your needs and financial situation can result in significant cost savings over time.

Tips on How to Effectively Compare Auto Insurance Plans

- Understand your coverage needs and priorities before starting the comparison process.

- Request quotes from at least three different insurance companies to get a comprehensive view of available options.

- Review the coverage details, exclusions, and limitations of each policy to ensure it aligns with your requirements.

- Consider the reputation and customer service record of the insurance provider to gauge their reliability in case of a claim.

- Take advantage of online tools and resources that simplify the comparison process and provide unbiased information.

Factors to Consider

When comparing auto insurance options, there are several key factors to keep in mind to ensure you are getting the best coverage for your needs at a competitive price. These factors can significantly impact your overall satisfaction with your policy and your financial well-being in the event of an accident.

Coverage Levels

Determining the appropriate coverage levels for your auto insurance policy is crucial when comparing different options. The coverage levels you choose will directly affect the cost of your premiums and the extent of protection you have in case of an accident.

It's essential to strike a balance between adequate coverage and affordability. Consider factors such as your vehicle's value, your driving habits, and your financial situation when evaluating coverage levels.

Deductibles

Deductibles play a significant role in auto insurance comparison as they impact how much you will pay out of pocket in the event of a claim. A deductible is the amount you are responsible for paying before your insurance kicks in to cover the rest of the costs.

Generally, choosing a higher deductible will result in lower premiums, but it also means you will need to pay more in case of an accident. On the other hand, a lower deductible means higher premiums but less out-of-pocket expenses when making a claim.

Consider your budget and risk tolerance when determining the right deductible for your needs.

Types of Coverage

When comparing auto insurance policies, it is important to understand the different types of coverage available to ensure you are adequately protected in case of an accident. Let's take a closer look at the main types of coverage and how they compare to each other.

Liability Coverage vs. Comprehensive Coverage

- Liability Coverage: This type of coverage helps pay for the other party's expenses if you are at fault in an accident. It typically includes bodily injury liability and property damage liability.

- Comprehensive Coverage: Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters.

Liability coverage is required by law in most states, while comprehensive coverage is optional but can provide added protection for your vehicle.

Significance of Personal Injury Protection

Personal Injury Protection (PIP) is another important type of coverage to consider when comparing auto insurance policies. PIP helps cover medical expenses for you and your passengers in case of an accident, regardless of who is at fault. It can also help with lost wages and other expenses related to injuries sustained in a car accident.

- PIP can be particularly beneficial if you do not have health insurance or have a high deductible, as it can help cover immediate medical costs.

- Some states require PIP coverage, while others offer it as an optional add-on to your policy. Be sure to check your state's requirements and consider adding PIP for added protection.

Premiums and Discounts

When it comes to auto insurance, premiums can vary significantly between providers. Insurance companies consider various factors when determining the cost of coverage, such as the driver's age, driving record, location, type of vehicle, and coverage limits. As a result, comparing quotes from different insurance companies can help you find the best premium for your specific situation.

Varying Premiums

- Insurance providers use different algorithms to calculate premiums based on risk factors.

- Factors like age, driving history, and location can impact the cost of insurance.

- Higher coverage limits and additional features can also increase premiums.

Discounts Impacting Costs

- Insurance companies offer various discounts that can help reduce the overall cost of coverage.

- Common discounts include safe driver discounts, multi-policy discounts, and good student discounts.

- Installing safety features in your vehicle or completing a defensive driving course can also qualify you for discounts.

Strategies for Affordable Premiums

- Compare quotes from multiple insurance providers to find the most competitive premium.

- Consider adjusting your coverage limits or deductible to lower your premium.

- Take advantage of discounts offered by insurance companies to reduce the cost of coverage.

Online Tools and Resources

When it comes to comparing auto insurance options, there are various online tools and resources available to help you make an informed decision. These tools can streamline the process and provide you with valuable insights into different insurance policies.

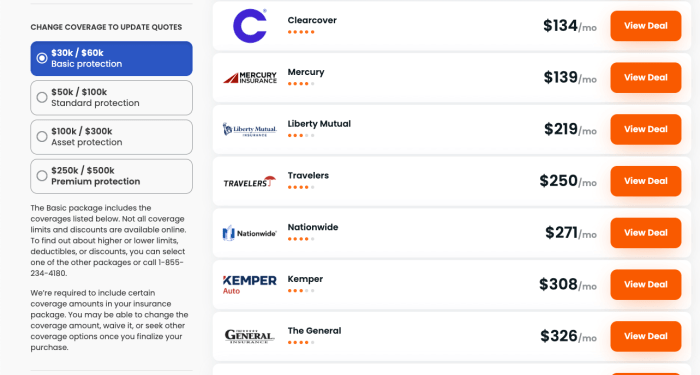

Comparison Websites

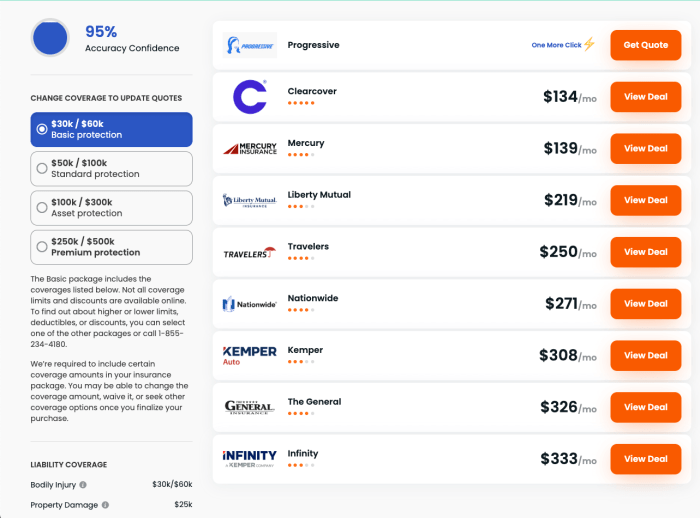

Comparison websites are an invaluable resource when it comes to finding the best auto insurance policy for your needs. These websites allow you to input your information once and receive multiple quotes from different insurance providers, making it easy to compare coverage options and prices.

- Save Time: Instead of contacting each insurance company individually, you can receive multiple quotes in one place.

- Save Money: By comparing prices from different providers, you can ensure you are getting the best deal possible.

- Easy Comparison: Comparison websites provide side-by-side comparisons of coverage options, making it easier to identify the best policy for your budget and needs.

Tips for Utilizing Online Resources

When using online tools to compare auto insurance, keep the following tips in mind to make the most out of your experience:

- Provide Accurate Information: Make sure to input accurate and up-to-date information to receive the most accurate quotes.

- Compare Coverage Levels: Don't just focus on the price

compare the coverage levels and benefits of each policy to ensure you are adequately protected.

- Check Customer Reviews: Look for customer reviews and ratings of the insurance providers to get an idea of their customer service and claims process.

- Utilize Filters: Use filters on comparison websites to narrow down your options based on factors like deductible amount, coverage limits, and more.

Last Point

As we conclude our journey through the realm of auto insurance comparison, remember that knowledge is power. Armed with the information and strategies shared here, you are equipped to navigate the complexities of insurance choices with confidence and clarity. Make the most of your newfound understanding and embark on your quest for optimal auto insurance coverage today!

Answers to Common Questions

Why is it important to compare auto insurance policies?

Comparing auto insurance policies allows you to find the best coverage at the most competitive rates tailored to your needs.

How can auto insurance comparison save money?

By exploring different providers and their offerings, you can identify cost-effective options and potential discounts that maximize savings.

What factors should I consider when comparing auto insurance?

Key factors include coverage levels, deductibles, and the types of coverage offered by each policy.

Are there online tools for auto insurance comparison?

Yes, there are various online tools and comparison websites that streamline the process of comparing auto insurance policies.

How do discounts impact the cost of auto insurance?

Discounts can significantly reduce your insurance premiums, making coverage more affordable without compromising quality.