Auto insurance near me sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. From understanding the basics of auto insurance to finding reliable providers nearby, this guide covers all aspects of this essential financial protection.

As we delve deeper into the world of auto insurance, you will uncover valuable insights on choosing the right coverage, factors influencing costs, and navigating the claims process with ease. So, let's embark on this informative journey together.

What is Auto Insurance?

Auto insurance is a contract between a policyholder and an insurance company that helps protect the policyholder financially in case of an accident, theft, or other damages to their vehicle. It is a crucial form of protection for drivers and vehicle owners, providing peace of mind and financial security.

Types of Coverage Included in Auto Insurance

Auto insurance typically includes several types of coverage to meet different needs and situations:

- Liability Coverage: Protects the policyholder in case they are at fault in an accident and must pay for the other party's medical expenses or vehicle repairs.

- Collision Coverage: Covers the cost of repairs or replacement of the policyholder's vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Provides protection for damages to the policyholder's vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover the costs if the policyholder is in an accident with a driver who does not have insurance or enough insurance to cover the damages.

Legal Requirements for Auto Insurance

The legal requirements for auto insurance vary by region, but in most places, drivers are required to have a minimum amount of liability coverage to legally operate a vehicle on public roads. Failure to comply with these requirements can result in fines, license suspension, or other penalties.

It is important for drivers to understand and meet the auto insurance requirements in their area to avoid legal consequences and ensure financial protection in case of an accident.

Finding Auto Insurance Providers Near Me

Finding the right auto insurance provider near you is crucial for ensuring you have the coverage you need at a competitive price. Here are some tips on how to locate local auto insurance providers:

Research Methods

- Utilize search engines: Conduct a simple online search using s like "auto insurance near me" to find a list of local providers in your area.

- Ask for recommendations: Reach out to friends, family, and colleagues for referrals to reputable auto insurance companies they have had positive experiences with.

- Check local directories: Look through local business directories or online listings to find auto insurance providers in your area.

Online Tools and Platforms

- Insurance comparison websites: Use online tools that allow you to compare quotes from multiple auto insurance providers at once to find the best rates.

- Mobile apps: Some insurance companies offer mobile apps that make it easy to find nearby agents, file claims, and manage your policy on the go.

- Social media: Follow auto insurance providers on social media platforms to stay updated on promotions, discounts, and local events they may be participating in.

Evaluating Reliability and Reputation

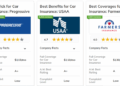

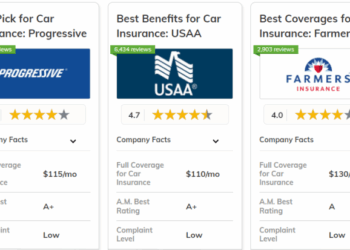

- Check reviews and ratings: Look for customer reviews and ratings online to get an idea of the level of service and satisfaction provided by different insurance companies.

- Verify credentials: Ensure that the auto insurance provider is licensed to operate in your state and has a good standing with regulatory bodies.

- Contact local agents: Reach out to local agents or representatives to ask questions about coverage options, discounts, and the claims process to gauge their expertise and responsiveness.

Factors Influencing Auto Insurance Costs

When it comes to auto insurance costs, several factors come into play that can significantly impact the premiums you pay. Understanding these factors can help you make informed decisions when selecting an insurance provider and coverage options.

Personal Driving History

Your personal driving history is one of the most influential factors in determining your auto insurance costs. Insurance companies typically look at factors such as your driving record, including any accidents or traffic violations, to assess your risk as a driver.

A clean driving record with no accidents or tickets can result in lower insurance premiums, while a history of accidents or violations may lead to higher costs.

Location and Vehicle Type

The location where you live and the type of vehicle you drive also play a significant role in determining your insurance rates. Urban areas with higher rates of accidents or vehicle theft may result in higher premiums compared to rural areas.

Similarly, the make and model of your vehicle, as well as its safety features, can impact the cost of insurance. Vehicles with a higher risk of theft or expensive repair costs may lead to higher premiums.Overall, understanding these factors and how they influence auto insurance costs can help you make informed decisions to find the best coverage options that suit your needs and budget.

Choosing the Right Auto Insurance Coverage

When it comes to choosing the right auto insurance coverage, it's important to understand the different types of coverage options available and how they can be customized to meet individual needs. Finding the right balance between coverage limits and deductibles is crucial to ensure adequate protection without overpaying.

Types of Auto Insurance Coverage Options

- Liability Coverage: This type of coverage helps pay for injuries and property damage that you cause to others in an accident.

- Collision Coverage: Covers damage to your own vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from damage not caused by a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover your expenses if you're in an accident with a driver who has insufficient insurance or no insurance at all.

- Personal Injury Protection (PIP) or Medical Payments Coverage: Covers medical expenses for you and your passengers in the event of an accident, regardless of fault.

Tips for Customizing Coverage

- Assess Your Needs: Consider factors like the value of your vehicle, your driving habits, and your budget to determine the coverage that best suits your needs.

- Review State Requirements: Make sure you meet the minimum auto insurance requirements in your state while also considering additional coverage options for enhanced protection.

- Consider Your Assets: If you have valuable assets to protect, you may want to opt for higher liability limits to safeguard your finances in case of a lawsuit.

- Bundle Policies: Combining auto insurance with other types of insurance, such as home or renters insurance, can often result in discounts and savings.

Importance of Balancing Coverage Limits and Deductibles

It's essential to strike a balance between coverage limits and deductibles when selecting auto insurance. While higher coverage limits provide greater protection, they also come with higher premiums. On the other hand, choosing a higher deductible can lower your premium but means you'll pay more out of pocket in the event of a claim.

Finding the right balance that meets your needs and budget is key to getting the most value out of your auto insurance policy.

Understanding Auto Insurance Claims Process

When it comes to auto insurance, understanding the claims process is crucial. Knowing the steps involved, common pitfalls to avoid, and the role of insurance adjusters can make the experience smoother in case you need to file a claim.

Steps in Filing an Auto Insurance Claim

- 1. Report the Incident: Contact your insurance company as soon as possible to report the incident and start the claims process.

- 2. Provide Information: Be prepared to provide details about the accident, including the date, time, location, and any other relevant information.

- 3. Document the Damage: Take photos of the damage to your vehicle and any other vehicles involved in the accident.

- 4. Get an Estimate: Your insurance company may require you to get an estimate for the repairs needed.

- 5. Review and Approval: Once the claim is filed, your insurance company will review the information and approve the claim if everything is in order.

Common Pitfalls to Avoid During the Claims Process

- 1. Delay in Reporting: It's important to report the incident to your insurance company promptly to avoid any delays in processing your claim.

- 2. Providing Incomplete Information: Make sure to provide all the necessary details and documentation to support your claim.

- 3. Accepting a Low Settlement: Don't settle for an amount that doesn't cover the full extent of your damages. You have the right to negotiate with your insurance company.

Role of Insurance Adjusters in Handling Claims

- Insurance adjusters are responsible for investigating claims, determining liability, and evaluating the extent of the damages.

- They may conduct interviews, review police reports, inspect the damage, and negotiate settlements with the parties involved.

- Their goal is to ensure a fair and timely resolution to the claim while representing the interests of the insurance company.

End of Discussion

In conclusion, auto insurance near me is not just a mere search query but a crucial decision that impacts your financial well-being. By arming yourself with the knowledge shared in this guide, you can confidently navigate the complexities of auto insurance and make informed choices that suit your needs.

Here's to safer roads and smarter insurance decisions.

Key Questions Answered

What factors influence auto insurance costs?

Auto insurance costs are influenced by factors such as driving history, location, vehicle type, and coverage limits.

How can I find local auto insurance providers near me?

You can use online tools, platforms, or consult with local agents to find auto insurance providers in your area.

What types of coverage are included in auto insurance?

Auto insurance typically includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.