Delving into the realm of life insurance companies, we uncover the intricate workings and vital role they play in securing financial futures. Get ready for an enlightening journey through the landscape of insurance policies and industry innovations.

The various types of policies, factors to consider when choosing a provider, and the impact of market trends on these companies will all be explored in detail.

Overview of Life Insurance Companies

Life insurance companies are financial institutions that provide individuals with protection against financial loss in the event of death. The primary function of these companies is to offer life insurance policies to policyholders, which pay out a sum of money to beneficiaries upon the death of the insured individual.

Life insurance companies play a crucial role in financial planning by providing a safety net for loved ones in case of unexpected events. These companies help individuals secure their financial future by ensuring that their families are taken care of financially, even in their absence.

How Life Insurance Companies Operate

Life insurance companies operate by collecting premiums from policyholders in exchange for coverage. They use actuarial science to assess the risk of insuring an individual and set premiums accordingly. By pooling together premiums from policyholders, life insurance companies are able to pay out claims to beneficiaries when needed.Life insurance companies make profits by investing the premiums they collect in various financial instruments such as stocks, bonds, and real estate.

The returns on these investments help offset the costs of paying out claims and operating expenses, allowing the companies to remain financially stable and profitable.

Types of Life Insurance Policies Offered

Life insurance companies offer a variety of policies to cater to the diverse needs of individuals. Understanding the different types of life insurance policies can help you make an informed decision based on your financial goals and circumstances.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It offers a death benefit to the beneficiary if the insured passes away during the term of the policy. Term life insurance is typically more affordable than other types of life insurance, making it a popular choice for individuals looking for temporary coverage.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the entire lifetime of the insured. In addition to the death benefit, whole life insurance also includes a cash value component that grows over time. Premiums for whole life insurance are higher compared to term life insurance but remain level throughout the life of the policy.

Universal Life Insurance

Universal life insurance offers flexibility in terms of premium payments and death benefits. Policyholders can adjust the premium amounts and death benefits based on their changing needs. The cash value component of universal life insurance earns interest at a rate set by the insurer, allowing for potential growth over time.

Variable Life Insurance

Variable life insurance allows policyholders to invest a portion of their premiums in separate accounts that are tied to stocks, bonds, or mutual funds. The cash value and death benefit of variable life insurance policies fluctuate based on the performance of the underlying investments.

This type of policy offers the potential for higher returns but also comes with greater risk.

Factors to Consider When Choosing a Life Insurance Company

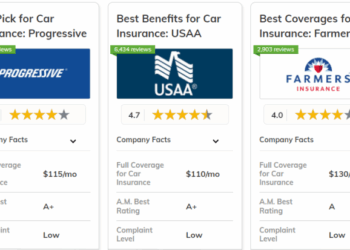

When selecting a life insurance company, there are several important factors to consider that can greatly impact your experience and coverage. It is crucial to evaluate the company's financial strength ratings, customer service, and claims processing efficiency to ensure you are making the right choice for your needs.

Financial Strength Ratings

Financial strength ratings play a key role in evaluating life insurance companies as they indicate the company's ability to fulfill its financial obligations and pay out claims. Look for companies with high ratings from agencies such as A.M. Best, Standard & Poor's, and Moody's to ensure your policy is backed by a financially stable provider.

Customer Service

Customer service is another critical factor to consider when choosing a life insurance company. A company that provides excellent customer service can offer you support and assistance throughout the policy application process, as well as during the life of your policy.

Look for companies with a reputation for responsive and helpful customer service.

Claims Processing Efficiency

Efficient claims processing is essential in ensuring that your beneficiaries receive the benefits they are entitled to in a timely manner. Evaluate the company's claims processing efficiency by researching customer reviews and ratings to see how quickly and smoothly claims are processed.

A company with a streamlined claims process can provide peace of mind that your loved ones will be taken care of when the time comes.

Technology and Innovation in the Life Insurance Industry

Technology is playing a crucial role in reshaping the operations of life insurance companies, leading to more efficient processes and improved customer experiences. From data analytics to artificial intelligence, advancements in technology are revolutionizing the industry.

Data Analytics and Artificial Intelligence in Underwriting Processes

Data analytics and artificial intelligence have significantly enhanced the underwriting processes of life insurance companies. By analyzing vast amounts of data, insurers can better assess risk profiles and tailor policies to individual customers. AI algorithms can quickly process information and provide more accurate pricing, leading to faster policy approvals.

Online Platforms and Mobile Apps for Customer Experience

- Online platforms and mobile apps have transformed the way customers interact with life insurance companies. Policyholders can now easily access their accounts, make payments, and file claims through user-friendly digital platforms.

- These digital solutions have streamlined the customer experience, offering convenience and accessibility 24/7. Customers can receive instant quotes, compare policies, and manage their coverage online, making the process more transparent and efficient.

- Furthermore, mobile apps provide personalized recommendations based on customer data, improving engagement and fostering long-term relationships between policyholders and insurers.

Regulatory Environment and Compliance

The regulatory environment plays a crucial role in overseeing the operations of life insurance companies. These regulations are put in place to protect consumers, ensure fair practices, and maintain stability in the industry.

Regulatory Framework for Life Insurance Companies

Life insurance companies are regulated by state insurance departments in the United States. These departments oversee licensing, financial solvency, market conduct, and compliance with state laws and regulations. Additionally, the National Association of Insurance Commissioners (NAIC) sets model laws and regulations that states can adopt to ensure consistency across the country.

Role of Regulatory Bodies

Regulatory bodies such as state insurance departments and the NAIC play a crucial role in ensuring consumer protection. They monitor the financial health of insurance companies, investigate consumer complaints, and enforce compliance with laws and regulations. By doing so, they help maintain the trust and confidence of policyholders in the insurance industry.

Key Compliance Requirements

Life insurance companies must adhere to various compliance requirements to operate legally and ethically. Some key compliance requirements include maintaining adequate reserves to pay claims, disclosing policy terms and fees clearly to consumers, and following anti-fraud measures to prevent fraudulent activities.

Compliance with these requirements is essential to protect policyholders and uphold the integrity of the insurance industry.

Market Trends and Challenges

In the dynamic landscape of the life insurance industry, it is crucial for companies to stay abreast of current market trends and navigate the challenges that come their way. Let's delve into the factors shaping the market and the hurdles faced by life insurance companies in today's competitive environment.

Current Market Trends Impacting Life Insurance Companies

Life insurance companies are experiencing a shift towards digitalization and personalized services to cater to changing consumer preferences. This trend is fueled by advancements in technology and data analytics, allowing companies to offer tailored products and streamline their operations. Additionally, there is a growing focus on sustainability and ethical investing, influencing the development of new insurance products with environmental and social considerations.

Challenges Faced by Life Insurance Companies in a Competitive Landscape

- Increasing competition from new market entrants, such as Insurtech startups, challenging traditional business models and customer acquisition strategies.

- Regulatory changes and compliance requirements, adding complexity and costs to operations.

- Lingering low-interest rate environments impacting investment returns and profitability.

- Addressing the changing demographics and preferences of the workforce, including the shift towards remote work and flexible benefits.

Impact of Economic Conditions on the Growth of Life Insurance Companies

The economic environment plays a significant role in shaping the growth prospects of life insurance companies. Factors such as interest rates, inflation, and overall economic stability can impact consumer purchasing power and investment returns. In times of economic uncertainty, life insurance companies may face challenges in attracting new policyholders and maintaining profitability.

It is essential for companies to adapt their strategies to navigate through varying economic conditions and ensure sustainable growth.

Corporate Social Responsibility Initiatives

Corporate Social Responsibility (CSR) initiatives are essential for life insurance companies to give back to the community and make a positive impact on society. These initiatives not only help in building a better society but also contribute to the overall reputation and customer loyalty of the company.

CSR Initiatives Undertaken by Life Insurance Companies

- Financial literacy programs to educate individuals on the importance of financial planning and insurance.

- Supporting healthcare initiatives by providing insurance coverage for underprivileged communities.

- Environmental sustainability efforts such as tree planting campaigns and reducing carbon footprint.

- Employee volunteer programs to engage staff in community service activities.

Importance of Community Engagement and Social Impact Programs

- Enhances the company's reputation and brand image in the eyes of customers and stakeholders.

- Strengthens relationships with the community and fosters a sense of trust and credibility.

- Creates a positive social impact by addressing key societal issues and contributing to the well-being of society.

Contribution of CSR Activities to Brand Reputation and Customer Loyalty

- CSR activities help in building a strong brand reputation by showcasing the company's commitment to social responsibility.

- Customers are more likely to trust and support companies that are actively involved in CSR initiatives.

- Enhanced customer loyalty as individuals feel connected to a company that cares about the community and social causes.

Final Wrap-Up

As we conclude our exploration, we reflect on the key takeaways from the world of life insurance companies. From regulatory environments to corporate social responsibility, these institutions shape not just financial security but also social impact.

FAQ Explained

What factors should I consider when choosing a life insurance company?

Consider the company's financial strength ratings, customer service reputation, and claims processing efficiency.

What are the key differences between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific term, while whole life insurance covers you for your entire life and includes a cash value component.

How do life insurance companies make profits?

Life insurance companies make profits through premiums collected from policyholders, investments, and underwriting income.