Exploring the realm of health insurance for families, this piece delves into the significance of securing adequate coverage for your loved ones. From understanding different plan options to maximizing benefits, this guide aims to equip you with essential knowledge to make informed decisions regarding your family's health.

As we navigate through the various aspects of health insurance tailored for families, you will gain insights into key considerations that can impact your choice of coverage.

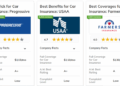

Overview of Health Insurance for Families

Health insurance for families is crucial in providing financial protection and access to quality healthcare services for all members of the family. It helps cover medical expenses, preventive care, and emergency treatments, ensuring peace of mind and overall well-being.

Types of Health Insurance Plans Available for Families

- Family Health Insurance Plans: These plans cover the entire family under a single policy, offering comprehensive coverage for all members.

- Employer-Sponsored Health Insurance: Many employers provide health insurance benefits for employees and their families, often at a reduced cost.

- Government-Sponsored Programs: Programs like Medicaid and CHIP offer affordable or free health insurance options for eligible families with low income.

Key Benefits of Having Health Insurance Coverage for the Whole Family

- Financial Protection: Health insurance helps protect families from high medical costs in case of illness, injury, or unexpected medical emergencies.

- Access to Quality Healthcare: With insurance coverage, families can access a network of healthcare providers, specialists, and hospitals for their medical needs.

- Preventive Care Services: Health insurance often covers preventive services like vaccinations, screenings, and annual check-ups, promoting overall health and wellness.

- Piece of Mind: Knowing that the family is covered by health insurance brings peace of mind and reduces stress related to medical expenses and healthcare needs.

Factors to Consider When Choosing Health Insurance for Families

When choosing health insurance for your family, there are several important factors to consider to ensure you select the best plan that meets your needs and budget.

Coverage Options for Different Family Sizes and Needs

- Family Size: Consider the number of family members you need to cover under the plan. Larger families may require more comprehensive coverage.

- Health Needs: Evaluate the specific healthcare needs of each family member, such as pre-existing conditions, chronic illnesses, or anticipated medical expenses.

- Network Providers: Check if your preferred doctors, specialists, and hospitals are included in the insurance plan's network to avoid additional out-of-pocket costs.

Evaluating Costs Associated with Health Insurance Plans

- Premiums: Compare monthly premiums for different plans and assess whether they fit within your budget.

- Deductibles and Copayments: Understand the out-of-pocket costs you will be responsible for before the insurance coverage kicks in, and consider how these amounts align with your financial situation.

- Prescription Coverage: If your family members require regular medications, ensure the insurance plan covers prescription drugs at a reasonable cost.

Coverage Options for Children in Family Health Insurance

When it comes to family health insurance plans, it is crucial to consider the specific coverage options available for children. Ensuring comprehensive coverage for pediatric services and preventive care is essential for the well-being of your children. Let's explore the different coverage options and how to guarantee that your children's healthcare needs are fully met.

Pediatric Services Coverage

- Most family health insurance plans include coverage for pediatric services such as well-child visits, immunizations, and developmental screenings.

- These services are vital for monitoring your child's growth and development, as well as detecting any potential health issues early on.

- Having access to pediatric specialists and services can provide specialized care tailored to your child's unique needs.

Preventive Care Coverage

- Family health insurance often covers preventive care services like annual check-ups, screenings, and vaccinations for children.

- Preventive care is essential for maintaining your child's health and well-being, as it helps identify and prevent potential health problems before they escalate.

- Regular preventive care can lead to early intervention and better health outcomes for your child in the long run.

Ensuring Comprehensive Coverage

- Review your family health insurance plan carefully to understand the specific coverage options for children, including any limitations or exclusions.

- Consider the healthcare needs of your children, such as any chronic conditions or ongoing treatments, to ensure that they are adequately covered.

- Consult with your insurance provider or a healthcare professional to discuss any additional coverage options that may be beneficial for your children.

Understanding Premiums, Deductibles, and Out-of-Pocket Costs

When it comes to health insurance for families, understanding premiums, deductibles, and out-of-pocket costs is crucial in managing healthcare expenses effectively. These terms play a significant role in determining how much a family will pay for medical services and treatments.

Premiums

Premiums are the fixed amount that families pay to the insurance company to maintain coverage. This is usually paid monthly, quarterly, or annually, regardless of whether the family seeks medical care or not. The premium amount can vary depending on the type of plan, coverage level, and number of family members included in the policy.

Deductibles

A deductible is the amount that families must pay out of pocket for covered healthcare services before the insurance company starts to contribute. For example, if a family has a $1,000 deductible, they must pay the first $1,000 of medical expenses before the insurance kicks in.

Deductibles can vary between plans and can impact how much a family pays for care throughout the year.

Out-of-Pocket Costs

Out-of-pocket costs refer to the expenses families incur for medical services that are not covered by insurance. This includes copayments, coinsurance, and any costs that exceed the deductible. Families may also have a maximum out-of-pocket limit, beyond which the insurance company covers all costs.

Managing these costs effectively is essential to avoid financial strain on the family budget.

Tips for Maximizing Benefits and Coverage

When it comes to maximizing health insurance benefits for your family, there are several strategies you can implement to ensure you are getting the most out of your coverage.

Utilize In-Network Providers for Cost Savings

One of the most effective ways to maximize benefits is by using in-network providers and services. Insurance companies have negotiated rates with these providers, which can result in significant cost savings for you. Before seeking medical care, always check if the provider is in-network to avoid higher out-of-pocket costs.

Navigate the Claims Process Efficiently

Understanding the claims process is crucial for maximizing your benefits. Make sure to keep detailed records of all medical expenses, treatments, and services received. Submit claims promptly and accurately to avoid delays in reimbursement. In case of claim denials or disputes, don't hesitate to appeal and provide any necessary documentation to support your case.

Last Word

In conclusion, prioritizing your family's health through a comprehensive insurance plan is a crucial step towards ensuring their well-being. By making informed choices and understanding the nuances of health insurance, you can secure a brighter and healthier future for your loved ones.

Key Questions Answered

What is the best type of health insurance plan for families?

The best type of health insurance plan for families often depends on factors like family size, medical needs, and budget. It's essential to compare different options to find the most suitable one for your family.

How can families evaluate the costs associated with health insurance plans?

Families can evaluate costs by considering premiums, deductibles, and out-of-pocket expenses. It's crucial to look at the overall expenses and benefits of a plan to determine its affordability.

Do health insurance plans for families cover pediatric services?

Yes, most health insurance plans for families include coverage for pediatric services, ensuring that children receive necessary medical care and preventive services.