Exploring the realm of life insurance for parents, this introduction delves into the importance of securing the future for your loved ones. Understanding the various policies available and factors to consider can provide clarity in making this crucial decision.

The following paragraphs will elaborate on the benefits of life insurance, factors affecting premiums, and the significance of estate planning in conjunction with life insurance for parents.

Understanding Life Insurance for Parents

Life insurance for parents is a crucial financial tool that provides protection and peace of mind for families in the event of unexpected tragedies. It ensures that children and spouses are financially secure even after the loss of a parent.

Here, we will delve into the types of life insurance policies available for parents and the key factors to consider when choosing the right policy.

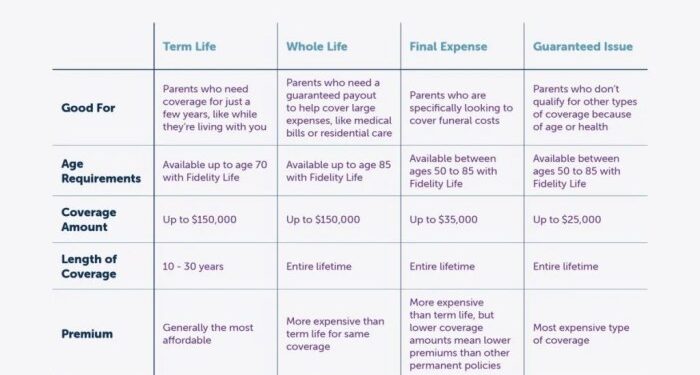

Types of Life Insurance Policies for Parents

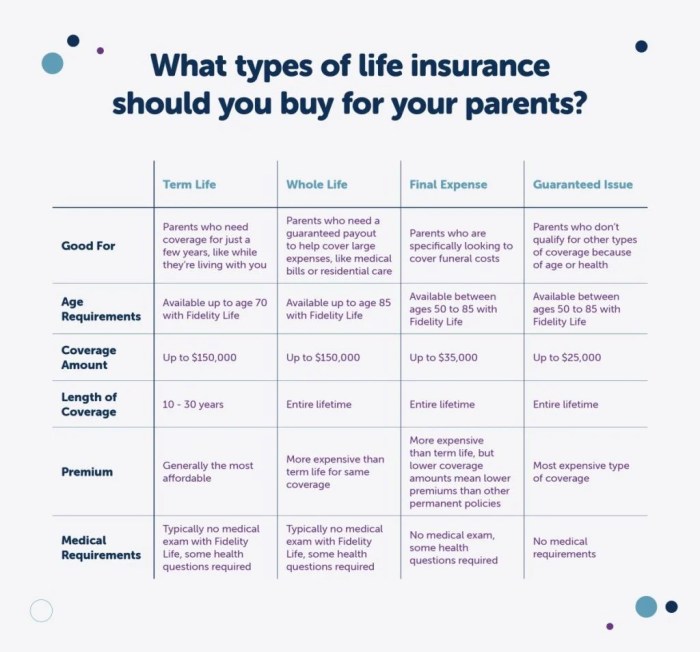

- Term Life Insurance: Provides coverage for a specific term, such as 10, 20, or 30 years. It is more affordable but does not accumulate cash value.

- Whole Life Insurance: Covers the insured's entire life and includes a cash value component that grows over time. Premiums are higher but offer lifelong protection.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits. It combines life insurance with a savings component that earns interest.

Key Factors to Consider When Choosing a Life Insurance Policy for Parents

- Amount of Coverage: Calculate the financial needs of your family, including debts, mortgage, education expenses, and income replacement.

- Premium Affordability: Determine a premium amount that fits your budget without compromising the coverage amount needed.

- Policy Riders: Consider additional riders like critical illness or disability coverage to enhance the policy's benefits.

- Insurance Company Reputation: Research and choose a financially stable and reputable insurance company with a track record of paying claims promptly.

- Policy Term: Decide on a term length based on the financial goals and needs of your family, such as until children are financially independent or for lifelong coverage.

Benefits of Life Insurance for Parents

Life insurance for parents provides essential financial security for the family in the unfortunate event of a parent's passing. It offers a safety net that ensures the family's well-being and helps cover various expenses that may arise.

Financial Security

Life insurance acts as a financial safety net for parents, ensuring that their loved ones are protected in case of an unexpected tragedy. It provides a lump sum payment to the beneficiaries, which can help cover daily expenses, outstanding debts, and future financial needs.

Expense Coverage

Life insurance can help cover significant expenses such as mortgage payments, education costs for children, and other debts that the family may have. In the absence of a parent, the life insurance payout can alleviate financial burdens and ensure that the family's financial stability is maintained.

Protection for the Future

In the event of a parent's passing, life insurance can protect the family's future by providing a financial cushion. This payout can help the surviving family members maintain their standard of living, pursue their goals, and secure their future without worrying about financial difficulties.

Factors Affecting Life Insurance Premiums for Parents

When it comes to life insurance for parents, several factors come into play that determine the cost of premiums. Understanding these factors can help parents make informed decisions when choosing a policy.Age:As with most types of insurance, age plays a significant role in determining life insurance premiums.

Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk compared to older individuals.Health:The health of the parent is another crucial factor in determining life insurance premiums.

Individuals with pre-existing health conditions or risky health habits may face higher premiums due to the increased likelihood of a claim being made.Coverage Amount:The amount of coverage you choose also impacts your life insurance premiums. Higher coverage amounts will result in higher premiums, as the insurance company will have to pay out more in the event of a claim

Longer-term policies typically have higher premiums compared to shorter-term policies. This is because the insurance company is exposed to the risk of a claim for a longer period of time.Tips to Lower Premiums:

1. Maintain a healthy lifestyle

Eating well, exercising regularly, and avoiding risky behaviors can help lower your premiums.

2. Compare quotes

Shop around and compare quotes from different insurance providers to find the best rate.

3. Choose the right coverage amount

Avoid over-insuring yourself and opt for a coverage amount that meets your needs without being excessive.

4. Consider term length

Evaluate your needs and choose a term length that aligns with your financial goals.

5. Bundle policies

Some insurance companies offer discounts for bundling multiple policies together, so consider bundling your life insurance with other insurance products for potential savings.

Importance of Estate Planning with Life Insurance

Life insurance plays a crucial role in estate planning for parents, offering a strategic way to ensure the smooth transfer of assets to beneficiaries upon the policyholder's passing. By integrating life insurance into their estate planning, parents can secure financial protection for their loved ones and address potential expenses that may arise during the distribution of assets.

Integration of Life Insurance into Estate Planning

Life insurance can be seamlessly integrated into estate planning by designating beneficiaries who will receive the death benefit payout. This allows parents to provide financial security for their children, spouse, or other dependents, ensuring they are taken care of financially in the event of the policyholder's death.

Additionally, life insurance can help cover outstanding debts, mortgages, and other financial obligations, preventing the burden from falling on the beneficiaries.

Smooth Transfer of Assets to Beneficiaries

One of the key benefits of incorporating life insurance into estate planning is the ability to facilitate a smooth transfer of assets to beneficiaries. The death benefit from the life insurance policy can be used to cover immediate expenses, such as funeral costs, estate taxes, and other liabilities, ensuring that the beneficiaries receive their inheritances without delays or financial strain.

This can help avoid potential disputes among family members and streamline the distribution process.

Coverage of Estate Taxes and Expenses

In addition to providing financial security for beneficiaries, life insurance can also help cover estate taxes and other expenses that may arise during the probate process. Estate taxes can significantly reduce the value of the assets passed down to beneficiaries, but the death benefit from a life insurance policy can be used to offset these taxes, preserving the wealth intended for the heirs.

By planning ahead with life insurance, parents can protect their estate from unnecessary financial burdens and ensure that their legacy is passed down efficiently.

Closing Notes

In conclusion, life insurance is not just a financial tool but a means of safeguarding your family's well-being. By understanding its nuances and integrating it into estate planning, parents can ensure a stable future for their children.

Answers to Common Questions

What types of life insurance policies are available for parents?

There are various options such as term life, whole life, and universal life insurance that parents can choose from based on their needs and budget.

How can parents lower their life insurance premiums?

Parents can maintain a healthy lifestyle, avoid high-risk activities, and compare quotes from different insurers to find the best rates.

Is life insurance necessary for parents with young children?

Yes, life insurance is crucial for parents with young children as it provides financial protection and ensures their future needs are met.