Exploring the realm of term life insurance, this introduction sets the stage for an enlightening discussion on the topic. It delves into the intricacies of this specific type of insurance, shedding light on its importance and relevance in today's world.

The following paragraphs will delve deeper into the definition, workings, types, and factors to consider when choosing term life insurance, providing a well-rounded view for readers seeking clarity on the subject.

Definition of Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period or term, typically ranging from 5 to 30 years. Unlike whole life insurance, which covers the insured individual for their entire lifetime, term life insurance only pays out a death benefit if the insured passes away during the term of the policy.

Key Features and Benefits of Term Life Insurance

- Cost-effective: Term life insurance is generally more affordable than whole life insurance, making it a great option for individuals looking for temporary coverage.

- Flexible terms: Policyholders can choose the term length that best suits their needs, whether it's 10, 20, or 30 years.

- Death benefit: In the event of the insured's death during the term of the policy, a tax-free lump sum is paid out to the beneficiaries.

- Renewable and convertible: Some term life insurance policies offer the option to renew or convert to a whole life policy at the end of the term.

Situations where Term Life Insurance is Most Suitable

- Young families: Term life insurance can provide financial protection for young families with dependents, ensuring they are taken care of in case of the policyholder's untimely death.

- Temporary financial obligations: Individuals with specific financial obligations that will diminish over time, such as a mortgage or children's college tuition, can benefit from term life insurance to cover these expenses.

- Business owners: Term life insurance can be used to protect business partners or cover business loans in case of the insured's passing.

How Term Life Insurance Works

Term life insurance works by providing coverage for a specified period of time in exchange for premium payments. Let's delve into how premiums are calculated, the typical duration of coverage, and what happens when the policy term ends.

Premium Calculation

Premiums for term life insurance policies are calculated based on several factors, including the insured individual's age, health, lifestyle, and the desired coverage amount. Generally, younger and healthier individuals pay lower premiums compared to older or less healthy individuals. Additionally, the length of the term and the type of policy chosen can also impact premium costs.

Duration of Coverage

Term life insurance policies typically offer coverage for terms ranging from 10 to 30 years. The insured selects the term length based on their financial obligations, such as mortgage payments, children's education, or other debts that need protection. Once the term ends, the coverage ceases, and the insured may have the option to renew the policy, convert it to a permanent life insurance policy, or let it lapse.

End of Policy Term

When the term of the policy ends, the coverage terminates, and the policyholder is no longer protected. At this point, the insured may have the option to renew the policy for a new term, convert it to a permanent life insurance policy, or let it lapse.

It's essential to review options carefully and consider any changes in financial circumstances before making a decision.

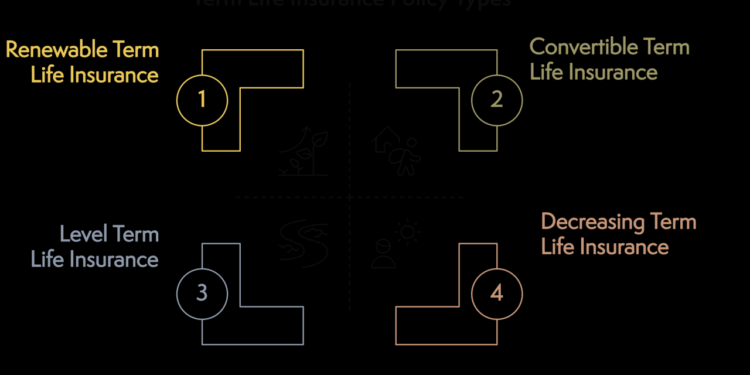

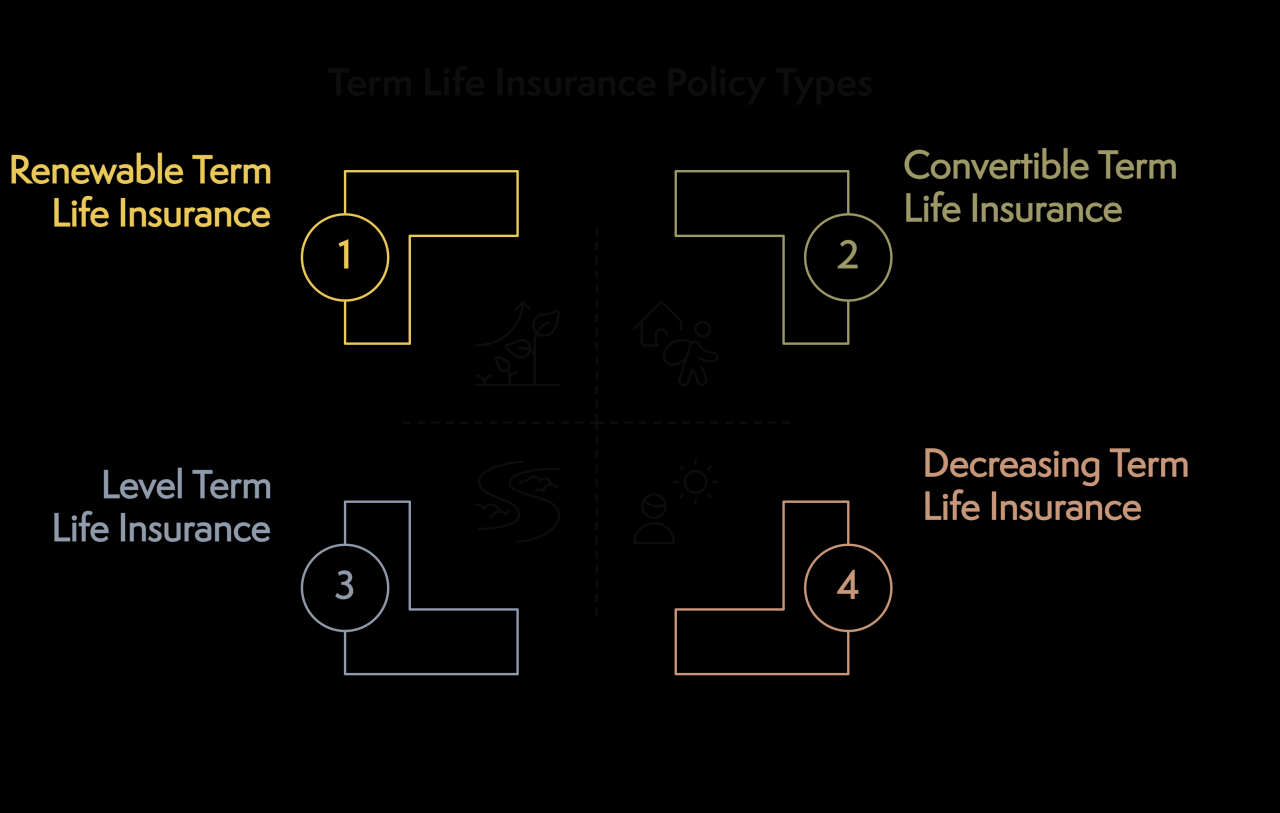

Types of Term Life Insurance

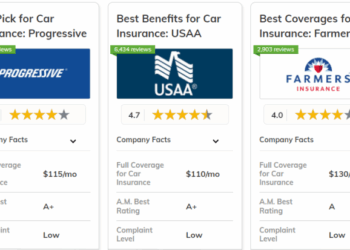

When it comes to term life insurance, there are different types available to suit various needs and preferences. Let's compare and contrast level term, decreasing term, and increasing term life insurance to understand their differences and benefits.

Level Term Life Insurance

Level term life insurance offers a fixed death benefit and premium throughout the duration of the policy. This means that the coverage amount remains the same over the term, providing consistent protection for your loved ones.

Decreasing Term Life Insurance

In contrast, decreasing term life insurance provides a death benefit that decreases over time. This type of policy is often chosen to cover specific financial obligations that decrease over the years, such as a mortgage or other debts.

Increasing Term Life Insurance

Increasing term life insurance offers a death benefit that increases over the term of the policy. This can help offset inflation and ensure that your coverage keeps pace with the rising cost of living.

Renewable and Convertible Term Life Insurance

Renewable term life insurance allows policyholders to renew their coverage at the end of the term without the need for a medical exam. On the other hand, convertible term life insurance allows policyholders to convert their term policy into a permanent life insurance policy without the need for a medical exam.

Riders and Add-Ons

There are various riders and add-ons that can be included with term life insurance policies to customize coverage based on individual needs. Some common examples include:

Accelerated Death Benefit Rider

Allows the policyholder to receive a portion of the death benefit if diagnosed with a terminal illness.

Waiver of Premium Rider

Waives premium payments if the policyholder becomes disabled and unable to work.

Child Term Rider

Provides coverage for children of the policyholder.

Return of Premium Rider

Returns premiums paid if the policyholder outlives the term of the policy.These additional options can enhance the coverage and flexibility of term life insurance policies to better meet the unique needs of policyholders and their families.

Factors to Consider When Choosing Term Life Insurance

When selecting a term life insurance policy, there are several key factors that individuals should consider to ensure they have the right coverage for their needs.

Age, Health, and Lifestyle Impact on Premiums

Age, health, and lifestyle are significant factors that can impact term life insurance premiums. Younger and healthier individuals typically receive lower premiums compared to older individuals or those with pre-existing health conditions. Additionally, individuals with high-risk lifestyles, such as smokers or extreme sports enthusiasts, may also face higher premiums.

Coverage Amount and Term Length Determination

Deciding on the coverage amount and term length is crucial when choosing a term life insurance policy. The coverage amount should be based on the financial needs of your dependents in case of your untimely death. Factors like mortgage payments, children's education costs, and other financial obligations should be taken into consideration.

The term length should align with the time period during which your dependents will be financially vulnerable. For example, if you have young children, you may opt for a longer term to ensure they are covered until they become financially independent.

Closing Notes

In conclusion, term life insurance is a crucial financial tool that offers peace of mind and security for individuals and their loved ones. By understanding its nuances and benefits, one can make informed decisions to protect the future.

Common Queries

What is the main difference between term life insurance and other types of life insurance?

Term life insurance provides coverage for a specific period, while other types may offer lifelong coverage or investment components.

How are premiums calculated for term life insurance policies?

Premiums are typically determined based on factors such as age, health, coverage amount, and term length.

What happens when the term of a term life insurance policy ends?

When the term ends, the coverage ceases, and the policyholder may have the option to renew the policy at a higher premium.