Delving into the realm of cheap health insurance, this introductory passage aims to intrigue and inform readers about the importance of finding affordable coverage.

As we navigate through the details in the following paragraphs, you will gain a comprehensive understanding of the various aspects of cheap health insurance.

Understanding Cheap Health Insurance

Cheap health insurance refers to a type of health coverage that offers lower premiums and out-of-pocket costs compared to more expensive plans. While the cost is lower, it still provides essential coverage for medical needs.

It is important to have affordable health insurance as it ensures access to necessary medical services without incurring significant financial burden. Cheap health insurance allows individuals and families to seek preventive care, manage chronic conditions, and address unexpected medical emergencies without worrying about exorbitant costs.

Benefits of Cheap Health Insurance

- Lower monthly premiums, making it more manageable for individuals on a budget.

- Coverage for essential health services such as doctor visits, prescription medications, and hospital stays.

- Protection from high medical costs in case of unexpected illnesses or injuries.

- Potential access to network providers for discounted rates on healthcare services.

Types of Cheap Health Insurance

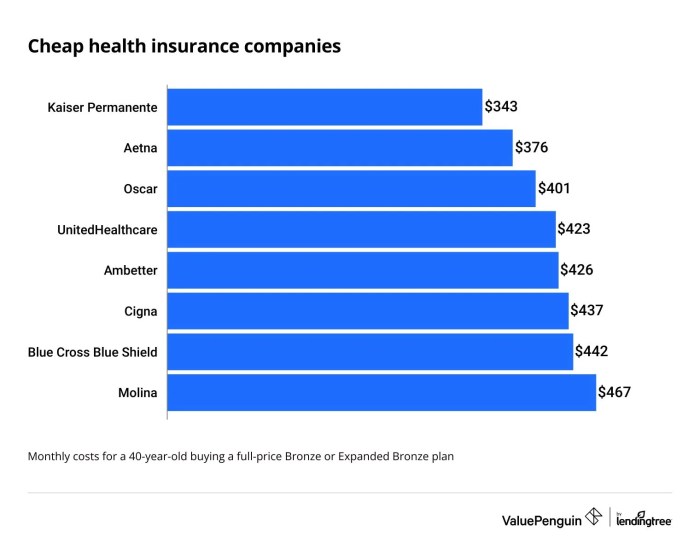

When it comes to affordable health insurance options, there are several types available to cater to different needs and budgets. Let's explore some of the popular low-cost health insurance plans and the coverage they provide.

1. Catastrophic Health Insurance

Catastrophic health insurance is designed to provide coverage for major medical expenses in case of a serious illness or injury. This type of plan usually has lower monthly premiums but higher deductibles. It is ideal for young and healthy individuals who want protection against significant medical costs.

2. High-Deductible Health Plans (HDHP)

High-deductible health plans require policyholders to pay a high deductible before the insurance coverage kicks in. These plans often come with lower monthly premiums and are compatible with Health Savings Accounts (HSAs). HDHPs are suitable for those who are looking to save on monthly premiums and are willing to pay higher out-of-pocket costs for medical services.

3. Short-Term Health Insurance

Short-term health insurance provides temporary coverage for individuals in between jobs, waiting for employer-sponsored health insurance to start, or facing other transitional periods. These plans offer basic medical coverage for a limited duration, typically up to 12 months.

4. Medicaid

Medicaid is a state and federally funded program that provides free or low-cost health coverage to eligible individuals and families with limited income. The program offers comprehensive benefits, including doctor visits, hospital stays, prescription drugs, and preventive care. Eligibility requirements vary by state.

5. Children’s Health Insurance Program (CHIP)

CHIP is a state and federally funded program that offers low-cost health coverage to children in families that do not qualify for Medicaid but cannot afford private insurance. The program covers a range of services, including doctor visits, immunizations, dental care, and vision care.

6. Health Insurance Marketplace Plans

Health Insurance Marketplace plans, also known as Obamacare plans, offer subsidized health insurance coverage to individuals and families who meet certain income requirements. These plans come in different tiers (Bronze, Silver, Gold, Platinum) with varying levels of coverage and cost-sharing.

Factors Affecting Cost

When it comes to determining the cost of health insurance, several factors come into play. These factors can significantly influence how affordable or expensive a health insurance policy may be for an individual or family.

Age

Age is a critical factor that affects the cost of health insurance. Generally, younger individuals tend to pay lower premiums compared to older individuals. This is because younger people are typically healthier and have a lower risk of developing serious health conditions.

Location

The geographic location of an individual can also impact the cost of health insurance. Health insurance premiums can vary depending on the state or region where the individual resides. Factors such as the cost of living, healthcare costs, and state regulations can all contribute to the differences in insurance pricing.

Lifestyle

An individual's lifestyle choices can also play a role in determining the cost of health insurance. For example, individuals who smoke, have a poor diet, or lead a sedentary lifestyle may be considered higher risk by insurance companies and, therefore, may face higher premiums.

Pre-existing Conditions

Having pre-existing medical conditions can significantly impact the price of cheap health insurance. Insurance companies may charge higher premiums or exclude coverage for certain conditions based on an individual's health history. This can make it challenging for individuals with pre-existing conditions to find affordable health insurance options.

Tips for Finding Affordable Health Insurance

Finding affordable health insurance can be a daunting task, but with the right strategies and resources, you can secure a plan that fits your budget and needs. Here are some tips to help you navigate the process and find a low-cost health insurance option:

Comparing Different Cheap Health Insurance Plans

When looking for affordable health insurance, it's crucial to compare different plans to find the best option for your situation. Consider factors such as premiums, deductibles, coverage limits, and out-of-pocket costs. Utilize online comparison tools or work with a licensed insurance broker to explore a variety of plans and make an informed decision.

Qualifying for Subsidies or Financial Assistance

Depending on your income level and household size, you may qualify for subsidies or financial assistance to help reduce the cost of health insurance. Visit the Health Insurance Marketplace or state-based exchanges to determine your eligibility for premium tax credits or cost-sharing reductions.

Additionally, Medicaid and the Children's Health Insurance Program (CHIP) offer low-cost or free health coverage for eligible individuals and families.

Resources for Finding Low-Cost Health Insurance Options

In addition to the Health Insurance Marketplace and state exchanges, there are other resources available to help you find low-cost health insurance options. Nonprofit organizations, community health centers, and local insurance agents can provide guidance and assistance in navigating the health insurance landscape.

Explore government programs, such as Medicare for seniors and individuals with disabilities, to find affordable coverage tailored to your needs.

Closure

In conclusion, the journey through the world of cheap health insurance has shed light on the key factors to consider when seeking economical coverage. As you embark on your quest for the ideal health insurance plan, armed with knowledge and insight, may you find the perfect fit for your needs.

FAQ Section

What is the minimum income requirement to qualify for cheap health insurance?

To qualify for cheap health insurance, individuals must meet specific income thresholds set by the government based on the federal poverty level.

Can I switch from an expensive health insurance plan to a cheap one mid-year?

Yes, you can switch health insurance plans during the year if you experience a qualifying life event, such as losing coverage from your employer.

Are there any restrictions on which doctors I can see with cheap health insurance?

Some cheap health insurance plans may have limitations on which healthcare providers you can visit, so it's important to check the plan's network before enrolling.