Embark on a journey into the world of car insurance calculators, where precision meets savings. Navigate through the complexities of insurance costs with ease as we explore the ins and outs of this invaluable tool.

Unravel the mysteries behind estimating your insurance expenses and discover how a calculator can be your best ally in securing the ideal coverage for your vehicle.

Why Use a Car Insurance Calculator?

Using a car insurance calculator can provide numerous benefits when it comes to estimating insurance costs and selecting the most suitable coverage for your vehicle.

Estimating Insurance Costs

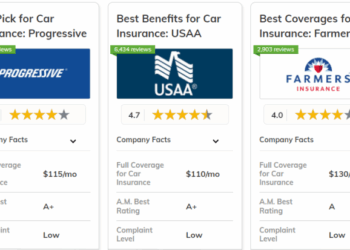

By inputting specific details about your car, driving history, and coverage preferences, a car insurance calculator can quickly generate an estimate of your insurance costs. This helps you make an informed decision based on your budget and coverage needs.

Comparing Quotes

Car insurance calculators allow you to compare quotes from multiple insurance providers in a matter of minutes. This saves you time and effort from individually reaching out to different companies for quotes, providing a convenient way to find the best deal.

Personalized Recommendations

Based on the information you input, a car insurance calculator can offer personalized recommendations on the type of coverage that may best suit your needs. This ensures that you are not overpaying for coverage you do not need or underinsured in case of an accident.

Scenario Analysis

In scenarios where you are considering purchasing a new car or moving to a new location, a car insurance calculator can help you anticipate changes in insurance costs. This allows you to plan ahead and budget accordingly for any adjustments in your insurance premiums.

How Does a Car Insurance Calculator Work?

When using a car insurance calculator, the process involves entering specific details about the vehicle and the driver to determine the insurance costs. This tool takes into account various factors to provide accurate estimates tailored to individual circumstances.

Information Required for Accurate Results

- Vehicle Information: Details such as make, model, year, and mileage of the car are needed to assess the insurance risk.

- Driver Information: Age, gender, driving history, and location are essential factors that influence insurance premiums.

- Coverage Options: The type and level of coverage desired by the driver impact the overall insurance cost.

- Claim History: Any past claims made by the driver can influence the premium calculations.

Factors Considered by the Calculator

- Driving Record: A clean driving history typically results in lower insurance rates, while accidents or traffic violations can increase premiums.

- Location: The area where the vehicle is primarily driven plays a role in determining insurance costs due to varying risk levels.

- Vehicle Type: The make, model, age, and safety features of the car impact insurance rates based on the likelihood of theft or accidents.

- Coverage Options: Choosing comprehensive coverage or adding extras like roadside assistance can affect the final insurance quote.

- Credit Score: In some cases, the driver's credit score may be considered as a factor in determining insurance premiums.

Factors Influencing Car Insurance Calculations

Car insurance premiums are determined by a multitude of factors that help insurance companies assess the risk associated with insuring a particular vehicle and driver. Understanding these factors can help you make informed decisions when selecting a car insurance policy.

1. Age and Driving Experience

Young and inexperienced drivers are typically charged higher premiums due to the higher likelihood of accidents. Insurance companies consider older, more experienced drivers to be less risky. For example, a 20-year-old driver may pay significantly more for insurance compared to a 40-year-old driver with a clean driving record.

2. Vehicle Make and Model

The type of car you drive can impact your insurance premium. Expensive cars, sports cars, and vehicles with high theft rates or costly repair expenses usually result in higher premiums. For instance, insuring a luxury sports car will likely cost more than insuring a modest sedan.

3. Driving Record

Your driving history plays a crucial role in determining your insurance costs. If you have a history of accidents, traffic violations, or DUIs, you are considered a higher risk and will face higher premiums. On the other hand, a clean driving record can lead to lower insurance rates.

4. Location

Where you live can affect your car insurance rates. Urban areas with higher traffic congestion and crime rates often have higher premiums compared to rural areas. For example, insuring a car in a busy city like New York may be more expensive than insuring the same car in a small town.

5. Credit Score

In some states, insurance companies use credit scores to determine premiums. A lower credit score can lead to higher insurance rates, as it is believed to be correlated with a higher likelihood of filing claims. Maintaining a good credit score can help lower your insurance costs.

6. Coverage Limits and Deductibles

The amount of coverage you choose and your deductible level can impact your insurance premium. Opting for higher coverage limits and lower deductibles will result in higher premiums. Conversely, choosing lower coverage limits and higher deductibles can help lower your insurance costs.

7. Annual Mileage

The number of miles you drive annually can also affect your insurance rates. The more you drive, the higher the risk of accidents. Drivers with lower annual mileage typically pay lower premiums compared to those who drive long distances regularly.

Tips for Using a Car Insurance Calculator

When using a car insurance calculator, it's crucial to follow some tips to ensure you get accurate results and make informed decisions about your insurance coverage. Here are some best practices to keep in mind:

Provide Accurate Information

- Make sure to input accurate details about your vehicle, driving history, and coverage needs. Any discrepancies can lead to inaccurate quotes.

- Double-check all the information you enter before submitting it to the calculator to avoid errors.

Compare Multiple Quotes

- Don't settle for the first quote you receive. Use the calculator to compare quotes from different insurance providers to find the best coverage at the most competitive rates.

- Consider factors like coverage limits, deductibles, and additional benefits when comparing quotes.

Understand the Coverage Options

- Take the time to understand the different types of coverage available and what each one includes. This will help you choose the right policy for your needs.

- Use the calculator to see how adjusting coverage options can impact your premium and find a balance between cost and coverage.

Review and Update Regularly

- Don't forget to revisit the calculator periodically to update your information and see if there are better deals available. Life changes, and so do your insurance needs.

- By reviewing and updating your details regularly, you can ensure you are always getting the best value for your money.

Ultimate Conclusion

In conclusion, armed with the knowledge and insights gained from this guide, you are now equipped to make informed decisions when it comes to your car insurance needs. Maximize your savings and optimize your coverage with the power of a car insurance calculator at your fingertips.

FAQ Insights

What are the benefits of using a car insurance calculator?

Using a car insurance calculator allows you to accurately estimate your insurance costs based on your specific needs and circumstances.

What information is required to get accurate results from a car insurance calculator?

Key details such as your vehicle information, driving history, and coverage preferences are crucial for obtaining precise results.

What are some common mistakes to avoid when using a car insurance calculator?

Avoid inputting incorrect information and overlooking important factors that could impact your insurance costs.