Exploring the realm of best auto insurance companies, this introduction sets the stage for a deep dive into the intricacies of this vital industry. Providing insights and analysis in a compelling manner, readers are invited to discover the nuances of selecting the right auto insurance company for their needs.

In the subsequent paragraphs, detailed information will be shared regarding the types of coverage, factors to consider when choosing an auto insurance company, top players in the market, and money-saving tips in the realm of auto insurance.

Overview of Auto Insurance Companies

Auto insurance plays a crucial role in protecting drivers from financial liabilities in case of accidents or damage to their vehicles. It is a legal requirement in many states, ensuring that all drivers have coverage to handle potential costs.

Types of Coverage Offered

Auto insurance companies typically offer several types of coverage, including:

- Liability coverage: This covers costs associated with damage or injuries to others in an accident where you are at fault.

- Collision coverage: This covers repairs or replacement of your vehicle in case of a collision with another vehicle or object.

- Comprehensive coverage: This covers damages to your vehicle from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you are in an accident with a driver who does not have insurance or enough coverage.

Factors Influencing Selection of the Best Auto Insurance Company

When choosing the best auto insurance company, several factors come into play, including:

- Cost: Comparing premiums and deductibles to find a policy that fits your budget.

- Coverage options: Evaluating the types of coverage offered and their limits to ensure adequate protection.

- Customer service: Checking reviews and ratings to assess the company's reputation for handling claims and providing assistance.

- Discounts: Inquiring about available discounts for safe driving, bundling policies, or other qualifying factors.

- Financial strength: Researching the company's financial stability to ensure they can fulfill claims in case of a high volume of incidents.

Factors to Consider When Choosing an Auto Insurance Company

When selecting an auto insurance company, there are several key factors that individuals should take into consideration to ensure they are getting the best coverage and service for their needs.

Customer Service Offerings

Customer service is crucial when it comes to auto insurance. Look for companies that have a reputation for providing excellent customer service, easy claims processes, and responsive support. Check reviews and ratings from current and past customers to gauge the level of service provided by each company.

Financial Stability and Reputation

It is essential to choose an auto insurance company that is financially stable and has a good reputation in the industry. A financially stable company will be able to pay out claims promptly and efficiently, giving you peace of mind in case of an accident.

Research the financial strength ratings of different insurance companies to ensure they can meet their obligations.

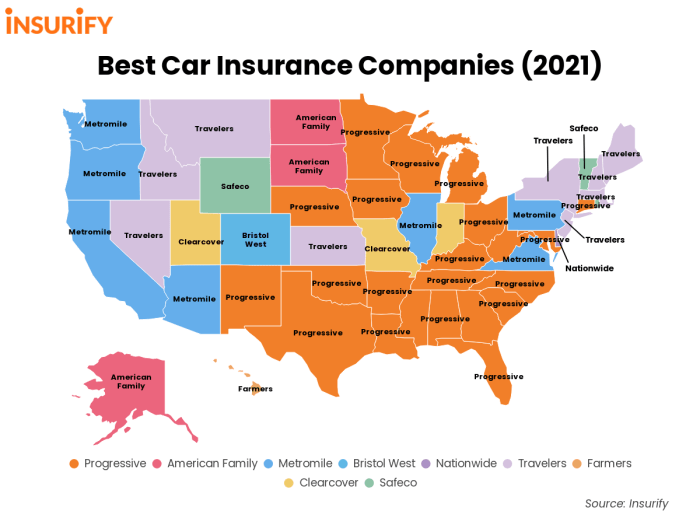

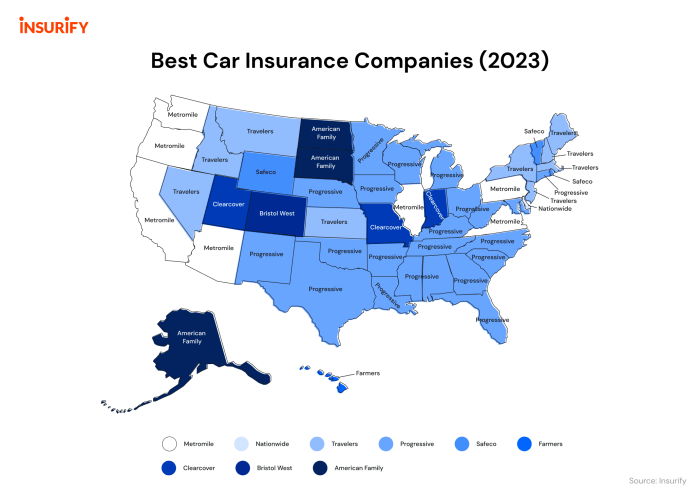

Top Auto Insurance Companies in the Market

When it comes to choosing the best auto insurance company, it's important to consider factors like customer reviews, coverage options, pricing, and unique features that set them apart from competitors.

1. State Farm

State Farm is one of the top auto insurance companies known for its excellent customer service and a wide range of coverage options. They offer competitive pricing and discounts for safe drivers. State Farm also provides personalized service through their network of agents.

2

. GEICO

GEICO is another popular choice for auto insurance with competitive rates and a user-friendly online platform. They are well-known for their advertising campaigns and offer a variety of coverage options to meet different needs. GEICO is often praised for its fast claims processing.

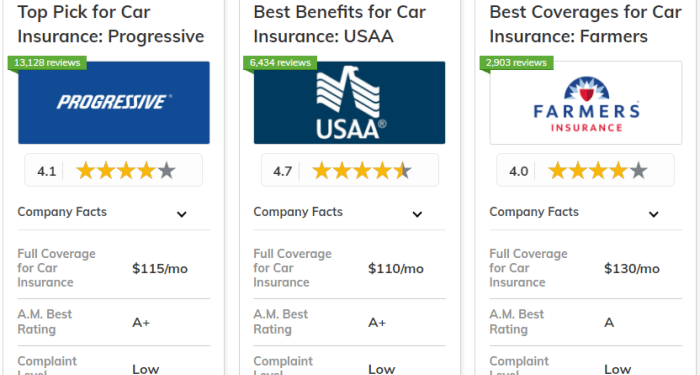

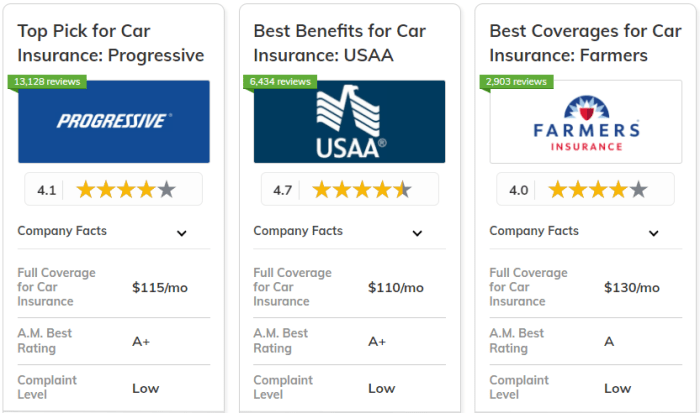

3. Progressive

Progressive is a leading auto insurance company that is known for its innovative approaches to coverage and pricing. They offer unique features such as Snapshot, which rewards safe driving habits with lower premiums. Progressive also provides a variety of discounts for bundling policies.

4. Allstate

Allstate is a well-established auto insurance company that offers a range of coverage options and discounts for policyholders. They are known for their reliable customer service and customizable policies to fit individual needs. Allstate also provides tools like Drivewise for safe driving rewards.

5. USAA

USAA is highly rated for its exceptional customer service and exclusive benefits for military members and their families. They offer competitive rates and a variety of coverage options tailored to the unique needs of military personnel. USAA is known for its financial stability and commitment to serving its members.

Tips for Saving Money on Auto Insurance

When it comes to auto insurance, finding ways to save money is always a priority. Here are some strategies to help you reduce your premiums, take advantage of discounts, and tailor your coverage to fit your needs while keeping costs low.

Shop Around for the Best Rates

One of the most effective ways to save money on auto insurance is to shop around and compare rates from different insurance companies. Each company has its own pricing model, so getting quotes from multiple providers can help you find the best deal.

Take Advantage of Discounts

- Look for discounts for safe driving records, multiple policies, and good student grades.

- Consider usage-based insurance programs that offer discounts based on your driving habits.

- Ask about discounts for anti-theft devices, safety features, or being a member of certain organizations.

Adjust Your Coverage to Fit Your Needs

While it's important to have adequate coverage, you can save money by adjusting your policy to fit your specific needs. For example:

- Consider raising your deductible to lower your premium, but make sure you can afford the out-of-pocket costs if you need to make a claim.

- If you have an older vehicle, you may not need comprehensive and collision coverage, which can be costly.

- Review your coverage limits to ensure you're not over-insured for certain types of coverage.

Conclusive Thoughts

In conclusion, this guide has shed light on the complexities of choosing the best auto insurance company. By understanding the key factors, comparing offerings, and exploring unique features, individuals can make informed decisions to protect their vehicles and finances.

User Queries

What factors should I consider when selecting an auto insurance company?

When choosing an auto insurance company, consider factors like coverage options, customer service quality, and the company's financial stability.

How can I save money on auto insurance?

To save money on auto insurance, you can look for discounts, adjust your coverage based on your needs, and maintain a good driving record.

What are some unique features offered by top auto insurance companies?

Top auto insurance companies may offer benefits like accident forgiveness, roadside assistance, and customizable coverage options.