Diving into the realm of homeowners insurance, this introduction sets the stage for an insightful exploration of the various aspects related to finding the best coverage. From understanding the basics to uncovering tips for saving, this guide aims to equip readers with valuable knowledge to make informed decisions.

Overview of Homeowners Insurance

Homeowners insurance is a crucial financial protection for individuals who own a home. It provides coverage for damage to the property, as well as liability protection in case someone is injured on the premises. Understanding the key components and types of homeowners insurance policies can help homeowners make informed decisions to safeguard their investment.

Key Components Covered by Homeowners Insurance

- Property Damage: Homeowners insurance typically covers damage to the physical structure of the home, including the walls, roof, and foundation, caused by covered perils such as fire, wind, or vandalism.

- Personal Belongings: Most policies also provide coverage for personal belongings inside the home, such as furniture, clothing, and electronics, in case of theft or damage.

- Liability Protection: Homeowners insurance includes liability coverage, which protects the homeowner in case someone is injured on the property and decides to sue.

Different Types of Homeowners Insurance Policies

- HO-1: Basic form that covers specific perils such as fire, theft, and vandalism.

- HO-3: Most common policy that covers the home's structure and personal belongings against all perils except those specifically excluded.

- HO-5: Comprehensive policy that offers broader coverage for both the home and personal belongings.

Examples of Situations Where Homeowners Insurance Can Be Beneficial

- If a tree falls on your house during a storm, causing damage to the roof, homeowners insurance can help cover the cost of repairs.

- In the event of a burglary where personal belongings are stolen, homeowners insurance can provide compensation for the lost items.

- If a guest slips and falls on your property, resulting in injuries and a lawsuit, liability coverage can help cover legal expenses and medical bills.

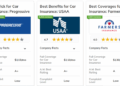

Factors to Consider When Choosing the Best Homeowners Insurance

When selecting a homeowners insurance policy, there are several factors to consider to ensure you are getting the best coverage for your needs. It's important to compare and contrast coverage options, deductibles, premiums, and personal property coverage limits among different insurance providers.

Additionally, understanding how the location of your home can impact insurance rates is crucial in making an informed decision.

Coverage Options, Deductibles, and Premiums

- Compare the coverage options offered by different insurance providers to ensure they meet your specific needs, such as protection for your home, personal property, and liability.

- Evaluate the deductibles associated with each policy, considering how much you can afford to pay out of pocket in the event of a claim.

- Compare premiums from different providers, keeping in mind that a lower premium may result in less coverage or higher out-of-pocket costs.

Personal Property Coverage Limits

- Assess the personal property coverage limits of each policy to ensure your belongings are adequately protected in case of damage or theft.

- Consider additional coverage options for high-value items, such as jewelry or electronics, that may exceed standard limits.

Impact of Home Location on Insurance Rates

- Understand how the location of your home, including factors like crime rates, weather risks, and proximity to emergency services, can impact insurance rates.

- Living in an area prone to natural disasters or high crime rates may result in higher insurance premiums, so it's important to factor this into your decision-making process.

Understanding Coverage Options

When it comes to homeowners insurance, understanding the different coverage options available is crucial to ensure you have the protection you need. Here, we will delve into common coverage options, scenarios where each type of coverage would be applicable, optional coverages, and the importance of reviewing policy endorsements and exclusions.

Dwelling Coverage

Dwelling coverage protects your home's structure in case of damage from covered perils such as fire, hail, or windstorms. For example, if a tree falls on your roof during a storm, dwelling coverage would help pay for repairs or rebuilding your home.

Personal Property Coverage

Personal property coverage safeguards your belongings inside your home, like furniture, electronics, and clothing, in case of theft, vandalism, or covered disasters. For instance, if your home is burglarized and your valuables are stolen, personal property coverage can help replace them.

Liability Protection

Liability protection covers legal expenses if someone is injured on your property and decides to sue you. This coverage also helps with medical bills if you're found responsible for the injury. For example, if a visitor slips and falls on your icy driveway, liability protection would assist with their medical costs.

Additional Living Expenses Coverage

Additional living expenses coverage comes into play when your home becomes uninhabitable due to a covered peril, such as a fire. This coverage helps with expenses like temporary housing and meals while your home is being repaired.

Optional Coverages

Optional coverages like flood insurance, earthquake insurance, and personal umbrella policies provide additional protection beyond standard homeowners insurance. Flood insurance is essential for homes in flood-prone areas, while earthquake insurance is crucial in earthquake-prone regions. Personal umbrella policies offer increased liability coverage beyond the limits of your standard policy.

Reviewing Policy Endorsements and Exclusions

It's essential to carefully review policy endorsements and exclusions to understand any additional coverages or limitations in your homeowners insurance policy. Endorsements can provide extra protection for specific items or situations, while exclusions Artikel what perils are not covered by your policy.

Tips for Saving on Homeowners Insurance

When it comes to saving on homeowners insurance, there are several strategies you can consider to help reduce your premiums and ensure you are getting the best value for your coverage.

Home Improvements and Security Systems

Investing in home improvements and security systems can lead to significant cost savings on your homeowners insurance. By enhancing the safety and security of your property, insurance companies may offer discounts on your premiums. Installing features such as smoke detectors, burglar alarms, deadbolt locks, and security cameras can help mitigate risks and potentially lower your insurance costs.

Bundling Insurance Policies

One effective way to save on homeowners insurance is by bundling your policies. Many insurance companies offer discounts to customers who purchase multiple policies from them, such as combining your homeowners and auto insurance. By bundling your insurance policies, you can enjoy cost savings while simplifying your coverage under one provider.

Regularly Reviewing and Updating Policies

It's essential to regularly review and update your homeowners insurance policy to ensure you have adequate coverage at the best possible rate. As your circumstances change, such as renovations, additions to your home, or changes in property value, updating your policy can help you avoid being underinsured or overpaying for coverage.

By staying informed about your policy and making adjustments as needed, you can optimize your insurance costs while maintaining comprehensive protection for your home.

Last Word

![Top 10 Best Home Insurance Companies Rates [The Truth] Top 10 Best Home Insurance Companies Rates [The Truth]](https://airconditioner.viralsumsel.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates.png)

In conclusion, the journey through the world of homeowners insurance unveils the importance of comprehensive coverage, careful consideration of options, and proactive strategies for savings. By staying informed and vigilant, homeowners can navigate the insurance landscape with confidence and peace of mind.

FAQ Section

What factors should individuals consider when choosing homeowners insurance?

Individuals should consider coverage options, deductibles, premiums, personal property limits, and the impact of home location on insurance rates.

What are some common coverage options provided by homeowners insurance?

Common coverage options include dwelling coverage, personal property coverage, liability protection, and coverage for additional living expenses.

How can homeowners save on insurance premiums?

Homeowners can save on premiums by implementing home improvements, installing security systems, bundling insurance policies, and regularly reviewing and updating their policies.

![Top 10 Best Home Insurance Companies Rates [The Truth]](https://airconditioner.viralsumsel.com/wp-content/uploads/2025/12/Top-10-Best-Home-Insurance-Companies-Rates-700x375.png)