With car insurance estimate at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Car insurance estimates play a vital role in financial planning, ensuring you have a clear understanding of potential costs and avoiding any surprises down the road.

Importance of Car Insurance Estimates

Before purchasing a car insurance policy, it is crucial to obtain a car insurance estimate. This estimate provides valuable information that can help you make informed decisions about your coverage.

Financial Planning and Budgeting

Car insurance estimates play a vital role in financial planning and budgeting. By knowing how much you can expect to pay for insurance coverage, you can adjust your budget accordingly and ensure that you have allocated the necessary funds for this expense.

Avoiding Financial Surprises

Accurate car insurance estimates help in avoiding financial surprises in the future. By having a clear idea of the costs associated with your insurance policy, you can prevent unexpected expenses that may strain your finances.

Factors Influencing Car Insurance Estimates

When it comes to calculating car insurance estimates, insurance companies take into account various factors that can significantly impact the final cost. Understanding these key factors is essential for drivers looking to obtain accurate estimates and make informed decisions.

Type of Vehicle

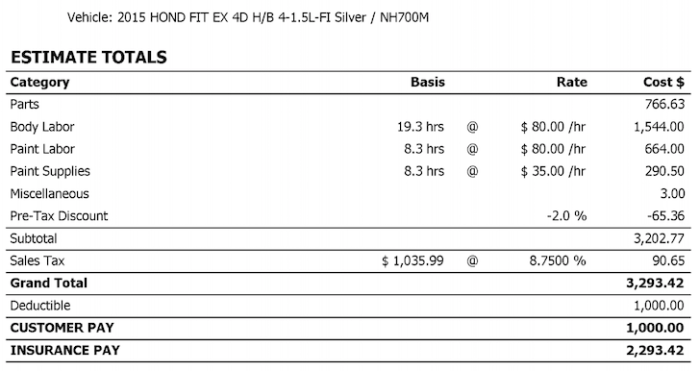

The type of vehicle you drive plays a crucial role in determining your car insurance estimate. Insurance companies consider factors such as the make and model of the car, its age, safety features, and the cost of repairs or replacement.

Generally, expensive or high-performance vehicles tend to have higher insurance rates compared to more affordable and safer cars.

Driver’s Age and Driving History

Your age and driving history are important factors that insurance companies analyze when calculating estimates. Younger drivers or those with a history of accidents or traffic violations are often considered higher risk and may face higher premiums. On the other hand, older drivers with a clean driving record typically receive lower insurance rates.

Location

Where you live also impacts your car insurance estimate. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. Additionally, the frequency of accidents and thefts in your area can influence the cost of insurance.

Deductibles, Coverage Limits, and Optional Coverages

The deductibles, coverage limits, and optional coverages you choose affect the final insurance estimate. A higher deductible means lower premiums but higher out-of-pocket costs in case of a claim. Similarly, opting for comprehensive coverage, roadside assistance, or rental car reimbursement will increase your premium but provide additional protection.Overall, understanding these factors and how they influence car insurance estimates can help you make informed decisions when selecting the right coverage for your needs.

How to Obtain Car Insurance Estimates

When it comes to getting car insurance estimates, there are a few different methods you can use to gather the information you need. Here is a step-by-step guide on how to request car insurance estimates from different providers.

Online Tools

Many insurance companies offer online tools that allow you to input your information and receive an estimate quickly and easily. These tools are convenient and can provide you with a general idea of what you might expect to pay for car insurance.

Insurance Agents

Another option is to contact insurance agents directly. They can gather information about your driving history, the type of car you drive, and other relevant details to provide you with a personalized estimate. Working with an agent can help you understand the nuances of different coverage options

Direct Contact Methods

If you prefer a more personal touch, you can reach out to insurance companies directly via phone or email to request an estimate. This method allows you to ask questions and clarify any doubts you may have about the coverage options available.

Regardless of the method you choose, it is crucial to provide accurate information when seeking car insurance estimates. Inaccurate or incomplete information can lead to inaccurate estimates, which may result in unexpected costs or inadequate coverage in the future.

Understanding Car Insurance Estimate Variations

When looking for car insurance, it's important to understand why estimates can vary significantly between different insurance companies. This variation is due to several factors that influence how insurance providers calculate their rates, such as the individual's driving record, age, type of vehicle, and coverage options.

Factors Influencing Car Insurance Estimate Variations

- Driving Record: A clean driving record typically results in lower insurance premiums, while a history of accidents or traffic violations can lead to higher rates.

- Age and Experience: Younger and less experienced drivers often face higher insurance costs due to the increased risk of accidents.

- Type of Vehicle: The make and model of the vehicle, as well as its safety features, can impact insurance rates. Sports cars and luxury vehicles tend to have higher premiums.

Comparing Estimates for the Best Coverage

- By obtaining car insurance estimates from multiple providers, you can compare the coverage options and prices to find the best deal. This allows you to choose a policy that offers the right amount of coverage at a competitive price.

- It's important to consider not only the cost but also the coverage limits, deductibles, and additional benefits included in the policy. A lower premium may not always mean better coverage.

Interpreting and Analyzing Variations

- When analyzing variations in car insurance estimates, pay attention to the coverage limits, deductibles, and any exclusions or limitations in the policy. Make sure you understand what is included and what is not covered.

- Consider factors that may impact the cost, such as discounts for safe driving, bundling policies, or choosing a higher deductible. These adjustments can help you customize your policy to fit your budget and needs.

Epilogue

In conclusion, car insurance estimates are not just numbers on a paper; they are crucial tools for responsible financial decision-making. By obtaining accurate estimates and understanding the factors that influence them, you can navigate the world of car insurance with confidence and security.

Question Bank

Why is it important to get a car insurance estimate before purchasing a policy?

Getting a car insurance estimate helps in understanding potential costs, making informed decisions, and avoiding financial surprises later on.

What factors influence car insurance estimates?

Insurance companies consider factors like the type of vehicle, driver's age, driving history, location, deductibles, coverage limits, and optional coverages when calculating estimates.

How can one obtain car insurance estimates?

You can request estimates from different providers through online tools, agents, or direct contact, ensuring accurate information is provided for a precise quote.

Why do car insurance estimates vary between companies?

Estimates can vary due to different calculations and coverage options offered by each insurance company. Comparing estimates can help in finding the best coverage at competitive prices.

How should one interpret variations in car insurance estimates?

Understanding and analyzing variations in estimates can help in making informed decisions and choosing the most suitable coverage for your needs.