Embarking on the journey of health insurance for freelancers, this guide delves into the intricacies of securing coverage in a freelance landscape. From understanding the significance of health insurance to unraveling the challenges faced by freelancers, this narrative sets the stage for a profound exploration of an essential topic.

As we delve further into the types of insurance plans available and factors to consider when choosing one, freelancers are equipped with valuable insights to make informed decisions regarding their health coverage.

Overview of Health Insurance for Freelancers

Health insurance for freelancers is a crucial aspect of managing their well-being and financial security. Unlike traditional employees who may receive health benefits from their employers, freelancers are responsible for obtaining and paying for their own health insurance coverage.

Importance of Health Insurance for Freelancers

- Ensures access to necessary medical care without incurring high out-of-pocket expenses.

- Provides financial protection against unexpected health issues or emergencies.

- Promotes overall well-being and peace of mind, allowing freelancers to focus on their work.

Challenges in Obtaining Health Insurance

- Lack of employer-sponsored benefits leading to higher costs for independent health plans.

- Difficulty in navigating the complex healthcare system to find suitable coverage options.

- Inconsistent income streams making it challenging to afford monthly insurance premiums.

Types of Health Insurance Plans Available

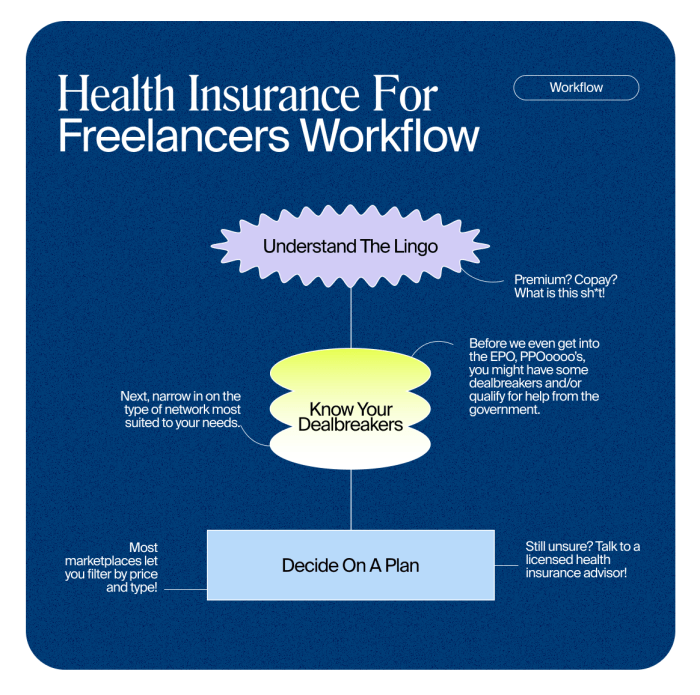

When it comes to health insurance for freelancers, there are several types of plans available to choose from. Each type has its own set of benefits and drawbacks, so it's important to understand the differences to make an informed decision.

Individual Health Plans vs Group Health Plans

Individual health plans are purchased directly by freelancers from insurance providers. These plans offer personalized coverage based on individual needs and preferences. On the other hand, group health plans are typically offered through organizations or associations that freelancers may be a part of.

These plans often provide more affordable rates due to group discounts.

High-Deductible Health Plans for Freelancers

High-deductible health plans (HDHPs) are an option for freelancers looking to lower their monthly premiums. These plans require higher out-of-pocket costs before insurance coverage kicks in. While HDHPs can be cost-effective for healthy individuals, they may not be suitable for those with chronic health conditions or frequent medical needs.

Factors to Consider When Choosing Health Insurance

When choosing a health insurance plan as a freelancer, there are several key factors to keep in mind to ensure you get the coverage that meets your needs.

Importance of Coverage for Pre-existing Conditions

It is crucial to consider whether the health insurance plan you are looking at covers pre-existing conditions. Having coverage for pre-existing conditions can be essential for managing ongoing health issues without incurring high out-of-pocket costs.

Evaluating the Network of Healthcare Providers

One important factor to consider is the network of healthcare providers included in the health insurance plan. Make sure that your preferred doctors, specialists, and hospitals are part of the network to ensure you can access the care you need without facing high out-of-network costs.

Cost of Health Insurance for Freelancers

When it comes to health insurance for freelancers, the costs can vary depending on various factors such as age, location, coverage options, and individual health needs. It is essential for freelancers to understand the typical costs associated with health insurance to make informed decisions.

Breakdown of Typical Costs

- Premiums: This is the amount freelancers pay each month for their health insurance coverage. Premiums can vary based on the type of plan chosen and the level of coverage.

- Deductibles: This is the amount freelancers must pay out of pocket before their insurance coverage kicks in. Lower deductibles usually mean higher monthly premiums.

- Co-payments and Co-insurance: These are additional costs that freelancers may have to pay when they receive medical services, on top of their premiums and deductibles.

- Out-of-Pocket Maximum: This is the maximum amount freelancers will have to pay for covered services in a plan year. Once this limit is reached, the insurance company covers 100% of the costs.

Finding Affordable Health Insurance Options

- Shop Around: Compare different health insurance plans to find the best coverage at an affordable price.

- Consider High Deductible Plans: High deductible plans often come with lower monthly premiums, making them a cost-effective option for freelancers.

- Look into Health Savings Accounts (HSAs): HSAs allow freelancers to save money tax-free for medical expenses, providing a way to offset healthcare costs.

- Join Freelancer Associations: Some freelancer associations offer group health insurance plans that can provide more affordable coverage options.

Potential Tax Benefits

Freelancers may be eligible for tax benefits related to health insurance, such as deducting premiums paid for health insurance from their taxable income. This can help reduce overall tax liability and make health insurance more affordable.

Resources and Assistance for Freelancers

As freelancers navigate the world of health insurance, there are various resources and assistance available to help them find suitable coverage options.

Government Programs for Freelancers

- Freelancers can explore government programs like Medicaid, which provides health coverage for individuals with limited income.

- Another option is the Affordable Care Act (ACA), also known as Obamacare, which offers health insurance plans through the Health Insurance Marketplace.

Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs)

- Freelancers can consider setting up Health Savings Accounts (HSAs) or participating in Health Reimbursement Arrangements (HRAs) through their clients or professional organizations.

- HSAs allow freelancers to save pre-tax dollars for medical expenses, while HRAs are employer-funded accounts that reimburse employees for qualified medical expenses.

Community-Based or Industry-Specific Group Health Insurance

- Freelancers can explore community-based or industry-specific group health insurance options that may be available through professional associations or freelance networks.

- These group plans can sometimes offer more affordable rates and broader coverage options compared to individual health insurance plans.

Last Word

In conclusion, this guide illuminates the path to navigating health insurance for freelancers, offering a roadmap to empowering freelancers with the knowledge needed to make sound healthcare choices. By understanding the costs, options, and resources available, freelancers can embark on their professional journeys with the security of adequate health coverage.

FAQs

Can freelancers qualify for subsidies when purchasing health insurance?

Yes, freelancers can qualify for subsidies based on their income levels when purchasing health insurance through the marketplace.

Are there options for freelancers with pre-existing conditions to get health insurance?

Freelancers with pre-existing conditions can explore options like high-risk pools or special enrollment periods to obtain health insurance coverage.

How can freelancers ensure they are choosing a plan with a suitable network of healthcare providers?

Freelancers can review the provider directories of health insurance plans to ensure their preferred healthcare providers are included in the network.