Home insurance coverage types set the stage for this informative discussion, offering homeowners a comprehensive understanding of the various options available to protect their property and belongings. From dwelling coverage to liability coverage, each type serves a unique purpose in safeguarding your home and assets.

Let's delve into the details of these coverage types to help you make informed decisions when choosing the right insurance for your needs.

As we navigate through the intricacies of home insurance coverage, you'll gain valuable insights into the features, benefits, and considerations of each type, empowering you to secure the protection you deserve.

Types of Home Insurance Coverage

When it comes to protecting your home, there are several types of insurance coverage options available to homeowners. Each type offers different features and benefits to suit various needs and preferences. Understanding the differences between these coverage options can help homeowners make informed decisions to ensure their homes are adequately protected.

Basic Coverage

Basic home insurance coverage typically includes protection for the structure of your home, personal belongings, liability coverage, and additional living expenses in case your home becomes uninhabitable due to a covered loss. While this type of coverage offers essential protection, homeowners may need to consider additional coverage options for comprehensive protection.

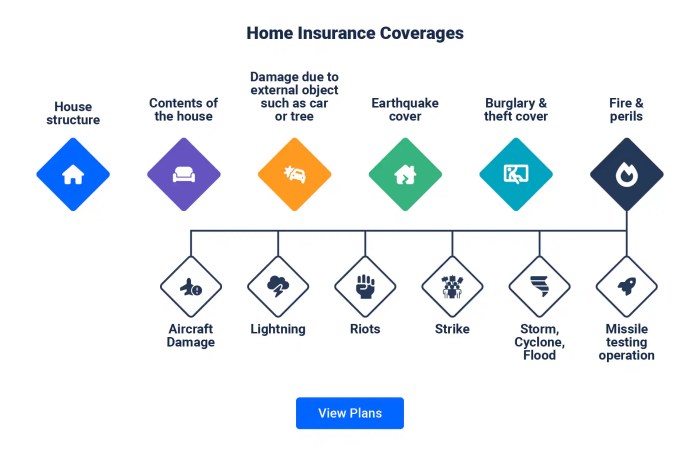

Comprehensive Coverage

Comprehensive home insurance coverage offers a broader range of protection compared to basic coverage. In addition to the features included in basic coverage, comprehensive coverage may also include coverage for natural disasters, such as floods, earthquakes, or hurricanes. This type of coverage provides more extensive protection for your home and belongings, giving you peace of mind in various situations.

Specialty Coverage

Specialty home insurance coverage is designed to meet the unique needs of homeowners who may require additional protection beyond what basic or comprehensive coverage offers. This type of coverage can include specific coverage for valuable items, such as jewelry, art, or collectibles, as well as coverage for home businesses or other special circumstances.

Specialty coverage allows homeowners to tailor their insurance to their individual needs.

Additional Coverage Options

In addition to the main types of home insurance coverage, homeowners can also consider adding extra coverage options to their policies. These can include identity theft protection, equipment breakdown coverage, or coverage for detached structures on your property. By exploring these additional coverage options, homeowners can further customize their insurance policies to meet their specific needs and concerns.

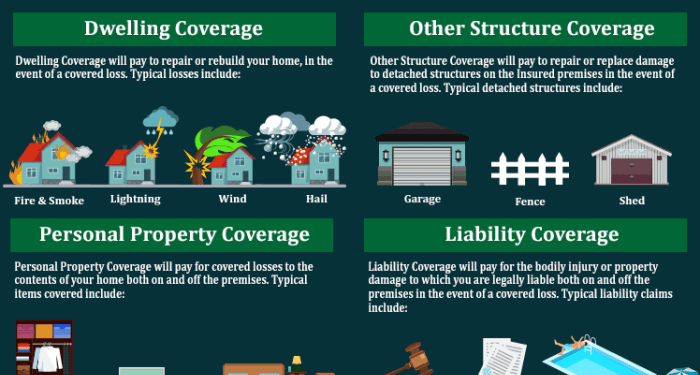

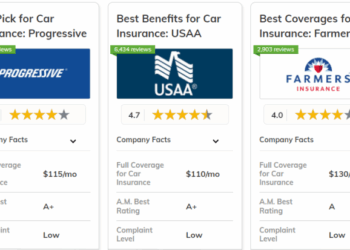

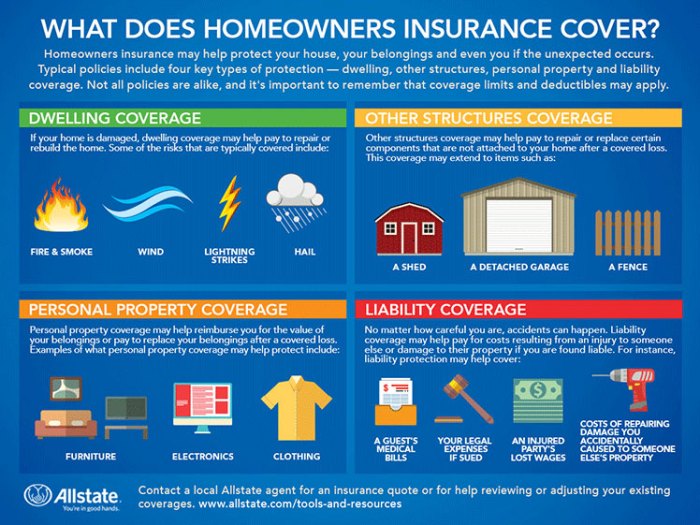

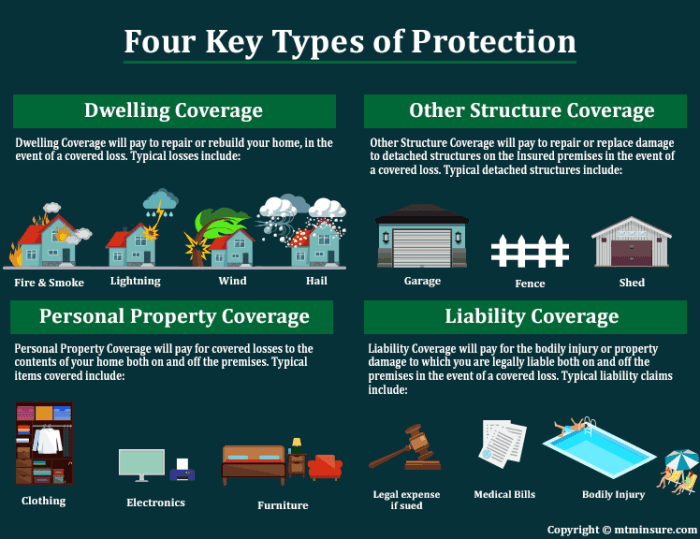

Dwelling Coverage

When it comes to home insurance policies, dwelling coverage is a crucial component that protects the physical structure of your home. This includes coverage for the walls, roof, foundation, and other attached structures like a garage or porch. Essentially, dwelling coverage ensures that your home is protected in case of damage or destruction due to covered perils.

What Dwelling Coverage Includes

Dwelling coverage typically includes protection against perils such as fire, lightning, hail, windstorms, and vandalism. It also covers the cost of rebuilding or repairing your home in the event of damage or destruction. Additionally, dwelling coverage may extend to other structures on your property, like a detached garage or shed.

Examples of Situations Requiring Dwelling Coverage

- If a tree falls on your roof during a storm and causes significant damage, dwelling coverage would help cover the cost of repairs.

- In the unfortunate event of a fire that damages the structure of your home, dwelling coverage would kick in to cover the rebuilding costs.

- If a vandal damages your property, dwelling coverage would provide financial assistance for repairs.

Determining the Amount of Dwelling Coverage

Determining how much dwelling coverage you need depends on factors like the square footage of your home, the construction materials used, and the local building costs. It's important to ensure that your dwelling coverage amount is sufficient to cover the cost of rebuilding your home in case of a total loss.

Consulting with an insurance agent or using online calculators can help you estimate the appropriate amount of coverage needed based on your property.

Personal Property Coverage

When it comes to home insurance, personal property coverage is a crucial component that helps protect your belongings in case of theft, damage, or loss. This type of coverage typically includes items such as furniture, clothing, electronics, and appliances that are not permanently attached to your home.

What is Included in Personal Property Coverage?

- Personal property coverage helps reimburse you for the cost of replacing or repairing your belongings if they are damaged or stolen.

- This coverage extends to items both inside your home and sometimes even outside of it, depending on the policy.

- It is important to review your policy to understand what specific items are covered and any limitations that may apply.

Accurately Assessing the Value of Your Belongings

- Make a detailed inventory of your personal belongings, including their original cost, purchase date, and current value.

- Consider using apps or software to help you organize and track your belongings more efficiently.

- Keep receipts, photos, and appraisals of high-value items to provide evidence in case of a claim.

Limitations and Exclusions to be Aware Of

- Some high-value items such as jewelry, art, or collectibles may have sub-limits or require additional coverage.

- Certain events like floods, earthquakes, or neglect may not be covered under personal property coverage and may require separate policies.

- Review your policy carefully to understand any exclusions or limitations that may impact your coverage.

Liability Coverage

Liability coverage in a home insurance policy protects homeowners in case someone is injured on their property or if they damage someone else's property.

What Liability Coverage Covers

- Medical expenses for someone injured on your property.

- Legal fees if you are sued for damages or injuries.

- Damages caused by your pets.

Scenarios Benefiting from Liability Coverage

- If a delivery person slips and falls on your icy driveway, liability coverage can help cover their medical bills.

- If your dog bites a neighbor, liability coverage can help with legal fees and any resulting damages.

- If a tree in your yard falls on your neighbor's car, liability coverage can help with the repairs.

Determining Appropriate Liability Coverage

Homeowners can determine the appropriate amount of liability coverage by considering factors like the value of their assets, the risk of lawsuits in their area, and their budget. It's recommended to have enough coverage to protect all assets and savings in case of a lawsuit.

Additional Living Expenses Coverage

Additional Living Expenses (ALE) coverage is a component of home insurance that helps cover costs incurred if you are temporarily unable to live in your home due to a covered loss, such as a fire or natural disaster. This coverage can help with expenses beyond your usual living costs, ensuring you have a place to stay and maintain your standard of living during the restoration process.

Types of Expenses Covered by ALE

- Temporary accommodations: ALE can help with the cost of staying in a hotel, rental property, or other temporary housing while your home is being repaired.

- Food expenses: This coverage can reimburse you for additional costs incurred for eating out or buying groceries during the displacement period.

- Transportation costs: ALE may cover the expenses related to commuting to work or school from your temporary residence if it is farther away than your usual home.

Tips for Maximizing ALE Coverage

- Keep receipts: Make sure to keep all receipts for expenses related to your temporary living arrangements, as you will need them to file a claim with your insurance company.

- Understand your policy limits: Be aware of the maximum amount your policy will cover for ALE, and try to stay within those limits to ensure you are fully compensated for your expenses.

- Communicate with your insurer: Inform your insurance company as soon as possible about your displacement and the expenses you are incurring, so they can guide you on what is covered and help streamline the claims process.

Other Structures Coverage

Other Structures Coverage in a home insurance policy typically includes coverage for structures on the property that are separate from the main dwelling. These structures are usually not attached to the main house but are still part of the property.

Examples of Structures Covered

- Detached garage

- Shed

- Gazebo

- Barn

- Fence

Ensuring Adequate Coverage

Homeowners can ensure they have adequate coverage for other structures on their property by accurately assessing the value of these structures and including them in their insurance policy. It's important to regularly review and update the coverage to reflect any changes or additions to the property.

Last Recap

In conclusion, understanding the nuances of home insurance coverage types is crucial for ensuring comprehensive protection for your most valuable assets. By exploring the different types of coverage and their benefits, you are better equipped to make informed decisions that align with your specific needs and priorities.

As you embark on the journey of securing your home insurance, remember that knowledge is your greatest asset in safeguarding what matters most to you.

FAQ Summary

What does personal property coverage include?

Personal property coverage typically includes belongings such as furniture, electronics, clothing, and other personal items within your home. It helps protect these items in case of theft, damage, or loss.

How can homeowners accurately assess the value of their personal belongings for coverage?

One way to assess the value of personal belongings is to create a home inventory listing all items with their estimated value. You can also consider getting appraisals for high-value items to ensure they are adequately covered.

What types of expenses can additional living expenses coverage help with?

Additional living expenses coverage can help with costs related to temporary accommodation, food expenses exceeding your normal budget, storage rental, and other necessary expenses if you're unable to live in your home due to a covered peril.