Delve into the world of home insurance quotes with this comprehensive guide that sheds light on the importance, factors influencing costs, types of coverage, and how to obtain and compare quotes effectively. Stay informed and make the best decisions for your home protection.

Importance of Home Insurance Quote

Getting a home insurance quote is crucial for homeowners as it provides financial protection and peace of mind in case of unexpected events or disasters.

Benefits of Having a Detailed Home Insurance Quote

- Accurate Coverage: A detailed home insurance quote ensures that your property is adequately covered for various risks such as fire, theft, or natural disasters.

- Cost-Effective: By comparing quotes from different insurers, you can find the best coverage at a competitive price, saving you money in the long run.

- Legal Requirement: In some cases, having home insurance is mandatory, especially if you have a mortgage on your property. A detailed quote helps you meet these legal obligations.

Protection Against Unforeseen Events

- Property Damage: In the event of a fire, flood, or other disasters, a home insurance quote can cover the cost of repairs or rebuilding your home.

- Liability Coverage: If someone is injured on your property, your home insurance quote can help cover medical expenses or legal fees in case of a lawsuit.

- Personal Belongings: Home insurance can also protect your personal belongings such as furniture, electronics, and other valuables in case of theft or damage.

Factors Influencing Home Insurance Quotes

When it comes to determining the cost of a home insurance quote, there are several key factors that insurance companies consider. These factors can vary depending on the provider, but some common elements play a significant role in shaping the insurance premium you'll pay.

Location of the Home

The location of your home is one of the primary factors that influence your home insurance quote. Homes located in areas prone to natural disasters such as hurricanes, floods, or earthquakes are considered high-risk by insurance companies. Additionally, the crime rate in your neighborhood can also impact your insurance premium.

Homes in safer neighborhoods with lower crime rates typically receive lower insurance quotes compared to those in high-crime areas.

Age and Condition of the Home

The age and condition of your home are crucial factors in determining your home insurance quote. Older homes may have outdated electrical systems, plumbing, or roofing, making them more susceptible to damages and insurance claims. Homes in good condition with modern amenities are generally considered lower risk by insurance companies, resulting in lower insurance premiums.

Regular maintenance and upgrades to your home can help reduce your insurance costs in the long run.

Types of Coverage in Home Insurance Quotes

When obtaining a home insurance quote, it is crucial to understand the various types of coverage included in the policy. Different types of coverage offer protection for different aspects of your home and belongings. Let's delve into the details below:

Basic Coverage

- Dwelling Coverage: This type of coverage protects the structure of your home, including the walls, roof, foundation, and other attached structures, in case of damage from covered perils such as fire, vandalism, or natural disasters.

- Personal Property Coverage: Personal property coverage helps replace or repair your belongings inside the home, such as furniture, clothing, and electronics, if they are damaged or stolen.

- Liability Coverage: Liability coverage protects you if someone is injured on your property and decides to sue you for medical expenses or legal fees.

- Additional Living Expenses Coverage: This coverage helps cover the costs of temporary living arrangements if your home is uninhabitable due to a covered loss.

Additional Riders

- Flood Insurance: While not typically included in standard home insurance policies, flood insurance can be added as a rider to protect your home and belongings in case of flooding.

- Jewelry or Valuable Items Coverage: This rider provides additional coverage for high-value items that may exceed the limits of your standard policy.

- Sewer Backup Coverage: This rider protects you in case your sewer system backs up and causes damage to your home.

- Earthquake Insurance: In areas prone to earthquakes, this rider can provide coverage for damages caused by seismic events.

Understanding the coverage options in your home insurance quote is essential in ensuring that you have adequate protection for your home and possessions. It is important to carefully review and compare the coverage details to choose the policy that best meets your needs and provides the necessary financial security in case of unexpected events

Obtaining and Comparing Home Insurance Quotes

When looking for the right home insurance policy, it is essential to obtain and compare quotes from different providers. This process allows you to find the best coverage at a competitive price. Here is a step-by-step guide on how to obtain and compare home insurance quotes effectively.

Obtaining Home Insurance Quotes

1. Research multiple insurance providers online or contact them directly to request quotes.

2. Provide accurate information about your home, such as its location, size, age, construction materials, security features, and any recent renovations.

3. Be prepared to answer questions about your personal belongings and any additional coverage you may need, such as liability protection or flood insurance.

Comparing Home Insurance Quotes

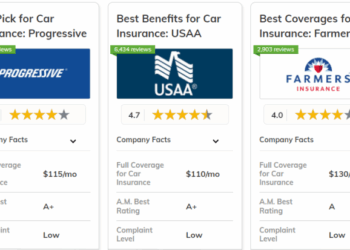

1. Review the coverage limits, deductibles, and exclusions of each quote to understand what is included in the policy.

2. Compare the premiums and discounts offered by each provider to determine the overall cost of the policy.

3. Consider the reputation and customer service of each insurance company to ensure they are reliable and responsive.

Tips for Ensuring Accuracy

1. Double-check all the information you provide to insurance providers to ensure accuracy in your quotes.

2. Ask for clarification on any terms or coverage details that you do not understand to make an informed decision.

3. Compare quotes side by side to see the differences in coverage and pricing before making a final decision.

Epilogue

In conclusion, understanding the nuances of home insurance quotes is crucial for safeguarding your home and assets. With the right knowledge and guidance, you can navigate the process with confidence and secure the coverage you need.

General Inquiries

What factors influence the cost of a home insurance quote?

The key factors include the location of your home, its age and condition, the coverage options chosen, and any additional riders added to the policy.

How do I obtain home insurance quotes from different providers?

You can obtain quotes by reaching out to insurance companies directly, using online comparison tools, or consulting with an insurance agent to gather multiple quotes for comparison.

What are the types of coverage typically included in a home insurance quote?

Common types of coverage include dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage in case of temporary displacement.

Why is it important to understand coverage options when reviewing a home insurance quote?

Understanding coverage options ensures that you are aware of what risks are covered and excluded, helping you make an informed decision based on your needs and budget.

How can I ensure accuracy when comparing home insurance quotes?

To ensure accuracy, provide consistent information to all insurers, review the coverage details and limits carefully, and ask for clarification on any discrepancies before making a decision.