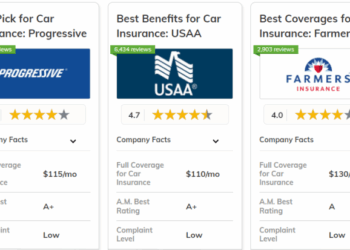

Life insurance is a crucial financial tool that provides security and peace of mind to you and your loved ones. Understanding the ins and outs of life insurance can help you make informed decisions for the future.

In this detailed guide, we will delve into the importance of life insurance, the various types of policies available, factors that influence premiums, how payouts work, and much more.

Importance of Life Insurance

Life insurance plays a crucial role in providing financial security for your loved ones in the event of your passing. It offers a safety net that can help cover expenses and replace lost income, ensuring that your family is taken care of even when you are no longer there to provide for them.

Financial Security for Loved Ones

Life insurance serves as a vital tool to protect your family from financial hardship after your death. The death benefit received can help cover funeral costs, outstanding debts, mortgage payments, and daily living expenses. This financial support can ease the burden on your loved ones during a difficult time and provide them with the resources they need to maintain their standard of living.

Peace of Mind

Knowing that you have life insurance coverage can offer peace of mind, both for you and your family. It provides reassurance that your loved ones will be taken care of financially, allowing you to focus on enjoying life without worrying about what the future may hold.

With life insurance in place, you can have confidence that your family's financial well-being is secure.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own features and benefits tailored to different needs. Let's explore the main types of life insurance policies available in the market.

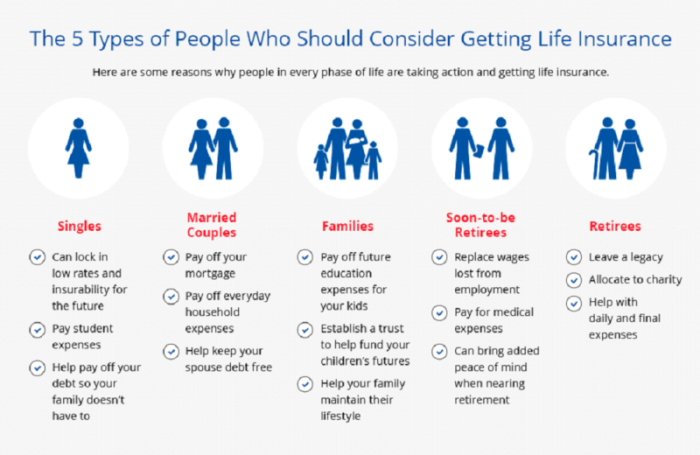

Term Life Insurance vs. Whole Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. On the other hand, whole life insurance provides coverage for the entire lifetime of the policyholder.

It also includes a cash value component that grows over time, allowing the policyholder to access funds while alive.

Term Life Insurance vs. Universal Life Insurance

Term life insurance is a pure death benefit coverage with no cash value component. It is more affordable compared to universal life insurance, which combines a death benefit with a savings component. Universal life insurance offers flexibility in premium payments and death benefit amounts, making it a versatile option for those looking for long-term coverage with investment opportunities.

Variable Life Insurance

Variable life insurance allows policyholders to allocate their premiums into investment accounts such as stocks and bonds. The cash value and death benefit of the policy can fluctuate based on the performance of these investments. This type of insurance offers the potential for higher returns but also comes with greater risk.

It provides the opportunity for policyholders to participate in the growth of their investments while still having a life insurance component in place.

Factors Affecting Life Insurance Premiums

Life insurance premiums are determined by a variety of factors that assess the risk associated with insuring an individual. Understanding these factors can help individuals make informed decisions when purchasing life insurance

Age and Health

Age and health are two major factors that significantly impact life insurance rates. Younger individuals generally pay lower premiums as they are considered lower risk compared to older individuals. Additionally, individuals in good health are likely to pay lower premiums than those with pre-existing medical conditions or a history of health issues.

Insurers often require applicants to undergo a medical examination to assess their health status before determining the premium rates.

Lifestyle Choices

Lifestyle choices such as smoking, excessive alcohol consumption, and participation in high-risk activities can also affect life insurance costs. Insurers consider these factors when calculating premiums as they contribute to an individual's overall risk profile. For example, smokers typically pay higher premiums than non-smokers due to the increased health risks associated with smoking.

Similarly, individuals who engage in dangerous hobbies or occupations may face higher premiums to compensate for the elevated risk of injury or death.

How Life Insurance Payouts Work

Life insurance payouts are a crucial aspect of the policy, ensuring that beneficiaries receive financial support after the policyholder's passing. Understanding how life insurance payouts work can help beneficiaries navigate the process with ease.When it comes to filing a life insurance claim, beneficiaries are typically required to submit a death certificate and the policy documents to the insurance company.

The insurer will then review the claim to ensure that it meets all the necessary requirements. Once approved, the payout process begins.

Different Payout Options

- Lump Sum Payment: This is the most common payout option where the beneficiary receives the entire death benefit in one payment.

- Installment Payments: Beneficiaries can choose to receive the death benefit in regular installments over a specified period.

- Annuity: Some policies offer the option to receive the death benefit as a series of payments over the beneficiary's lifetime.

Beneficiaries play a crucial role in receiving life insurance proceeds. They need to ensure that all required documents are submitted promptly and accurately to the insurance company. Additionally, beneficiaries may need to decide on the payout option that best suits their financial needs.Overall, understanding the process of filing a life insurance claim, the different payout options available, and the responsibilities of beneficiaries can help ensure a smooth and efficient payout process during a challenging time.

Ending Remarks

As we wrap up our discussion on life insurance explained, it's clear that this financial product is not just about money—it's about providing a safety net for your family and ensuring their well-being even after you're gone. Make sure to explore your options and choose a policy that best suits your needs.

Key Questions Answered

What factors influence life insurance premiums?

Factors such as age, health, lifestyle choices, and the type of policy can impact life insurance premiums.

How do life insurance payouts work?

When a policyholder passes away, beneficiaries can file a claim to receive the death benefit. Payout options include lump sum payments or periodic installments.

What is the significance of having life insurance?

Life insurance provides financial security for your loved ones by ensuring they are taken care of in the event of your passing. It offers peace of mind knowing that your family's future is protected.