Delve into the world of term life insurance rates with this informative guide that sheds light on the intricacies of how rates are determined and what factors play a pivotal role in the process. Prepare to embark on a journey of understanding and empowerment as we explore the realm of term life insurance rates.

Overview of Term Life Insurance Rates

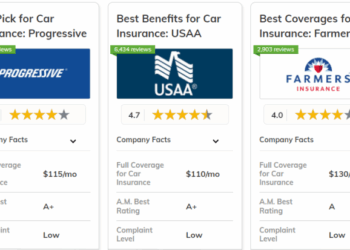

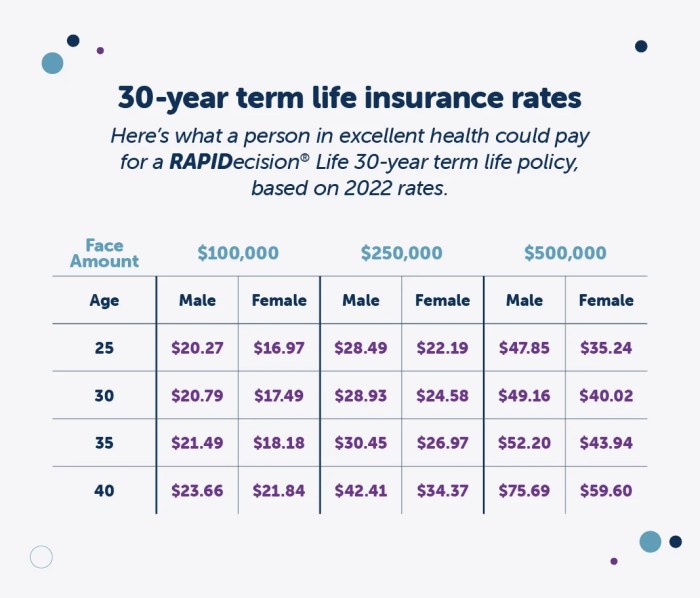

Term life insurance rates refer to the premium amount that policyholders pay to maintain coverage for a specific period, usually ranging from 10 to 30 years. These rates are calculated based on various factors that assess the risk associated with insuring an individual for a particular term.Factors that influence term life insurance rates include the policyholder's age, gender, overall health, lifestyle habits (such as smoking), occupation, and the coverage amount and term length desired.

Younger individuals typically receive lower rates compared to older individuals, as they are considered less risky to insure. Additionally, non-smokers generally pay lower rates than smokers due to the health risks associated with smoking.

Calculation of Term Life Insurance Rates

Term life insurance rates are determined by insurance companies using actuarial tables that analyze mortality risk based on the factors mentioned above. These tables help insurers estimate the likelihood of a policyholder passing away during the term of the policy and adjust rates accordingly.Insurance companies also consider additional factors such as medical history, family health background, and any pre-existing conditions when calculating term life insurance rates.

The more risk factors an individual presents, the higher their premium is likely to be.

Examples of Factors Influencing Term Life Insurance Rates

- Age: Younger individuals typically pay lower rates compared to older individuals.

- Health: Individuals in good health generally receive more affordable rates.

- Lifestyle: Non-smokers and individuals with healthy lifestyle habits may qualify for lower premiums.

- Occupation: Riskier occupations may lead to higher insurance rates.

- Coverage Amount and Term Length: Higher coverage amounts and longer terms can result in higher premiums.

Types of Term Life Insurance Rates

When it comes to term life insurance rates, there are two main types to consider: level term and decreasing term. Each type has its own set of advantages and disadvantages, depending on your individual needs and circumstances.

Level Term Life Insurance Rates

Level term life insurance rates provide a consistent death benefit throughout the term of the policy. This means that the coverage amount remains the same, and the premiums are typically fixed for the duration of the term. One advantage of level term life insurance rates is the predictability they offer, making it easier to budget for the future.

Additionally, this type of policy can be beneficial for those who want to ensure a consistent amount of coverage for their loved ones.On the other hand, one disadvantage of level term life insurance rates is that the premiums are typically higher compared to decreasing term rates.

This can make it more expensive in the short term. However, if you value consistency and predictability in your coverage, level term life insurance rates may be the right choice for you.

Decreasing Term Life Insurance Rates

Decreasing term life insurance rates provide a death benefit that decreases over time. This type of policy is often used to cover specific financial obligations that decrease over time, such as a mortgage or other debts. One advantage of decreasing term life insurance rates is that they can be more cost-effective than level term rates, especially if you only need coverage for a specific period.However, a disadvantage of decreasing term life insurance rates is that the coverage amount decreases over time, which may not be suitable for those looking to leave a larger inheritance or provide long-term financial security for their loved ones.

It is important to carefully consider your financial goals and obligations before choosing this type of policy.In summary, level term life insurance rates offer consistent coverage and premiums, making them ideal for those seeking predictability. On the other hand, decreasing term life insurance rates can be more cost-effective but may not provide the same level of long-term security.

Consider your individual needs and financial situation when choosing between these two types of term life insurance rates.

Factors Affecting Term Life Insurance Rates

When determining term life insurance rates, insurance companies consider various factors that help assess the risk associated with providing coverage to an individual. These factors play a crucial role in determining the final premium amount a person will pay for their term life insurance policy.

Age

Age is a critical factor that influences term life insurance rates. Generally, younger individuals are considered less risky to insure compared to older individuals. As a result, younger policyholders typically enjoy lower premium rates for term life insurance.

Health

The health condition of an individual is another significant factor that affects term life insurance rates. Insurance companies assess the overall health of the applicant through medical examinations, health history, and lifestyle habits

Lifestyle

Lifestyle choices such as smoking, excessive drinking, or engaging in high-risk activities can impact term life insurance rates. Individuals with risky behaviors are often charged higher premiums to offset the greater likelihood of premature death or health issues.

Coverage Amount

The coverage amount selected by an individual also influences term life insurance rates. Higher coverage amounts typically result in higher premiums since the insurance company is at greater financial risk if a large payout is needed.

Tips to Lower Term Life Insurance Rates

- Maintain a healthy lifestyle by exercising regularly and following a balanced diet.

- Quit smoking and limit alcohol consumption to improve your overall health profile.

- Shop around and compare quotes from different insurance providers to find the best rate.

- Opt for a term length that aligns with your needs to avoid overpaying for unnecessary coverage.

- Consider bundling policies or choosing a group plan through your employer for potential discounts.

Comparing Term Life Insurance Rates

When it comes to purchasing term life insurance, comparing rates from different providers is crucial in order to secure the best coverage at the most affordable price. By comparing term life insurance rates, individuals can ensure they are getting the most value for their money and tailor their policy to meet their specific needs.

Importance of Comparing Term Life Insurance Rates

It is important to compare term life insurance rates from different providers as it allows individuals to:

- Identify the most competitive rates in the market

- Find a policy that aligns with their budget and financial goals

- Evaluate the coverage options and benefits offered by each provider

- Ensure they are getting the best possible value for their premium payments

How to Effectively Compare Term Life Insurance Rates

Individuals can effectively compare term life insurance rates by:

- Requesting quotes from multiple insurance companies

- Considering the length of the term and coverage amount

- Reviewing the reputation and financial stability of the insurance provider

- Seeking guidance from a licensed insurance agent or broker

Online Tools for Comparing Term Life Insurance Rates

There are several online tools and resources that can help individuals compare term life insurance rates, such as:

- Insurance comparison websites like Policygenius and Insure.com

- Insurance company websites that offer quote calculators

- Independent insurance agents who can provide quotes from multiple carriers

- Financial websites that provide reviews and comparisons of different insurance providers

Final Summary

In conclusion, term life insurance rates are a crucial aspect of financial planning and security. By being armed with the knowledge presented in this guide, individuals can make informed decisions to safeguard their loved ones' future. Dive into the world of term life insurance rates today and secure a better tomorrow.

Query Resolution

What factors can influence term life insurance rates?

Factors such as age, health, lifestyle choices, and coverage amount can all impact term life insurance rates significantly.

How are term life insurance rates calculated?

Insurance companies consider various factors like age, health history, and coverage length to calculate term life insurance rates.

What are the advantages of level term life insurance rates?

Level term life insurance rates offer consistent premiums throughout the policy term, providing stability and predictability for policyholders.